There is a lot of explain to do today with regard to price action in the EURUSD and the GBPUSD. It has to do with the taiil (the EURGBP) wagging the dog (the EURUSD and the GBPUSD).

At times, the pairs against the USD dominate. I like to think in terms of the dog wagging the tail. The dog being the mighty USD.

Other times, pairs like the EURGBP (the tail of the dog) wreck havoc with the dog (the USD pairs). This occurs often because of professional trader deal flows in the cross currency pairs like the EURGBP. That action in turn can cause all sorts of potential moves in the USD pairs (ii.e. EURUSD and GBPUSD for the EURGBP). It can also confuse traders - in particular retail traders.

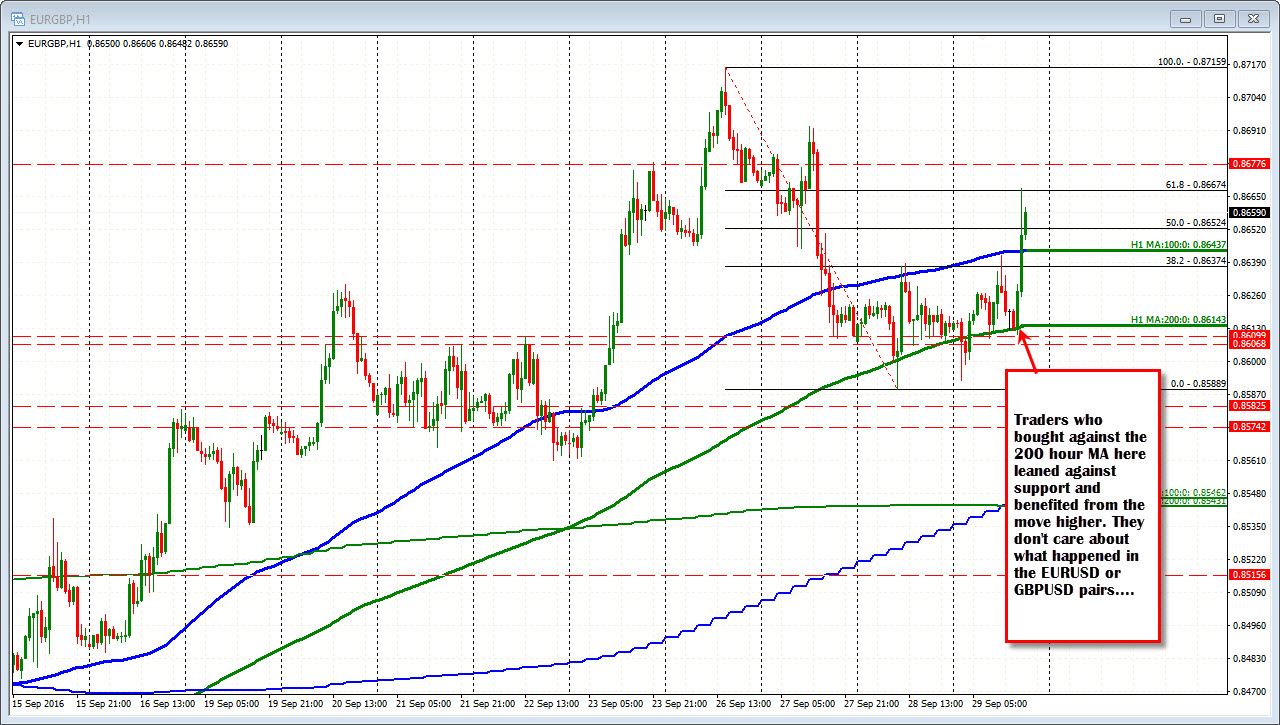

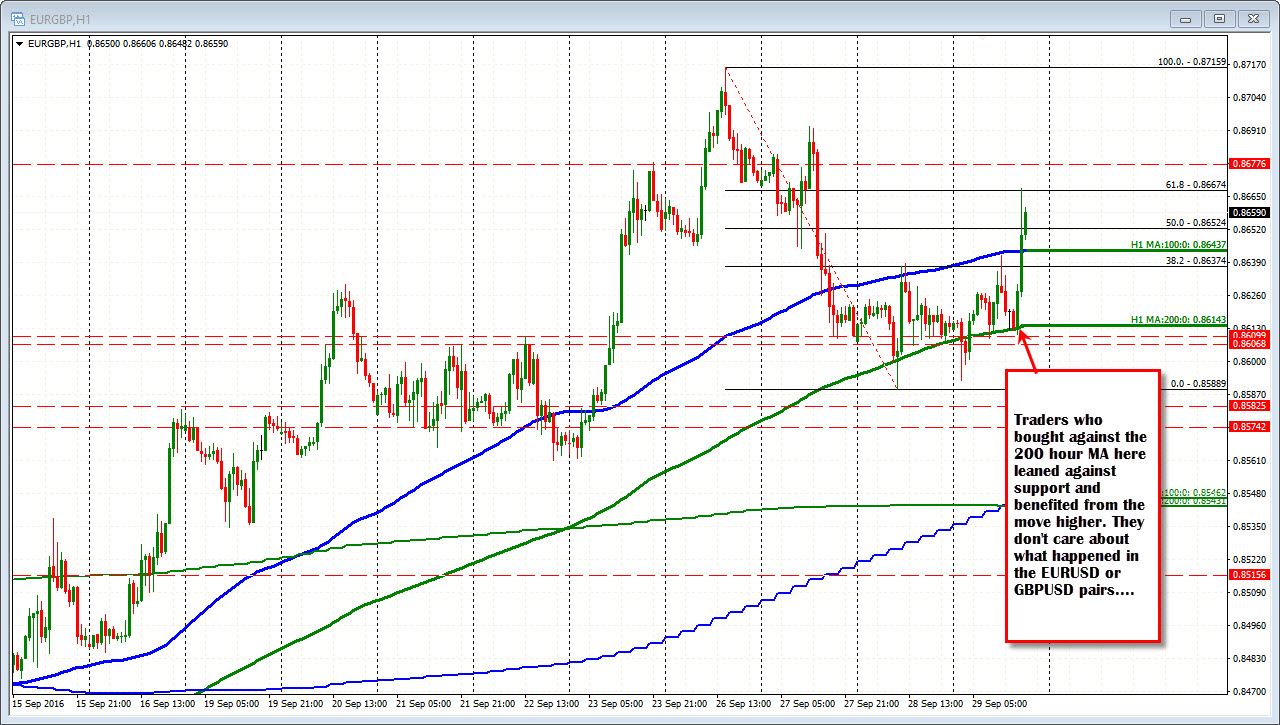

For example, it was not a few minutes ago that the EURUSD was the beneficiary of some EURGBP buying. The EURGBP bounced off the 200 hour MA, and that in turn pushed the EURUSD higher. The focus of the move in the EURGBP was on the EURUSD. The GBPUSD was not really moving. Why?

To understand you have to understand that the EURGBP is really made up of being long/short EURUSD and short/long GBPUSD.

Assume, you are long EURUSD. IF you have that position, you are long EUR and short USD. If you are short GBPUSD, you are short GBP and long USD.

So if you had those two positions and you focused on the USD part, you would be short USD from the EURUSD position and long USD from the GBPUSD position. That short and long cancel each other out. What you are left with is a EURGBP long position. You are long EUR and short GBP.

Trader can create a synthetic long in the EURGBP (assuming USD positions are equal and opposite each other) by going long EURUSD and going short GBPUSD (if you end up with that position in your trading book, watch the EURGBP price because that is the position you have).

Now, if you expect the EURGBP to go higher what are you expecting?

If the EURGBP goes higher it means the EUR is outperforming the GBP. The EUR is stronger than the GBP.

How can the EURGBP going higher manifest itself in the EURUSD and the GBPUSD pairs (assuming USD positions are equal but opposite in those pairs).

Well, mathematically, if the EURGBP goes higher it can be because

- The EURUSD goes higher at a faster pace than the GBPUSD going higher. So if the EURUSD goes up by 3 units (that unit can be whatever amount), and GBPUSD goes up by only 1 unit, the EURGBP moves higher.

- It can mean the EURUSD goes higher and the GBPUSD goes lower. So the EURUSD goes up by 2 units (whatever that unit is) and the GBPUSD goes down by 1 unit, that would raise the EURGBP.

- It can mean the EURUSD and the GBPUSD both go lower but the EURUSD falls a rate slower than the GBPUSD. So if the EURUSD falls 1 unit but the GBPUSD falls by 5 units over the same time, then the EURGBP willl go higher even though both pairs are going lower.

Now, often times, you can see the favored pattern.

Fore example today, as the EURGBP bounced off support, the EURUSD moved higher with it. The GBPUSD meanwhile was going sideways. So the EURUSD was the dominant pair.

More recently, the roles reversed.

The EURGBP continued to move higher, but instead of the EURUSD leading the way, the EURUSD stalled and the GBPUSD started to tumble lower. The net effect was that EURGBP could continue to go higher, but it was not being led by the EURUSD anymore, but more from the GBPUSD moving lower.

When a pair like the EURGBP domiinates it can wreck havoc with the pairs against the dollar. I like to think of it as the tail wagging the dog instead of the dog wagging the tail. The EURUSD and GBPUSD can often trade by themselves (and follow each other for the most part) but when the tail wags the dog (i.e. the EURGBPs move starts to dominate), the dog can herk and jerk around in a volatile fashion.

If you can recognize the dynamics early (i.e. trending action in the EURGBP), you can at least explain the volatility and perhaps confusion from the price action in the EURUSD and GBPUSD pairs i.e. why is the EURUSD going higher but the GBPUSD just sitting there? Well, it is because the EURGBP is trending higher.

You can then choose to play in the game or sit out until the tail stops wagging the dog.

Alternatively, you can play the game by focusing your trading on the EURGBP instead. Traders who bought the EURGBP against the 200 hour MA today (see chart below), don't really care what happens in the EURUSD or GBPUSD . They just want to see the EUR outperform the GBP. They want to see that tail dominate the dog - at least for a while.