The earlier surge in GBPJPY highlights the impact that large order flows can have on the market.

Further to my response to reader Jerry's question in the comments section I just thought I'd add a bit more detail about how to trade these flows.

Subscribers to our ACT course online last Summer heard me expound in more detail about what still remains a mystery to many retail traders who have not experienced the cut n thrust of market making.

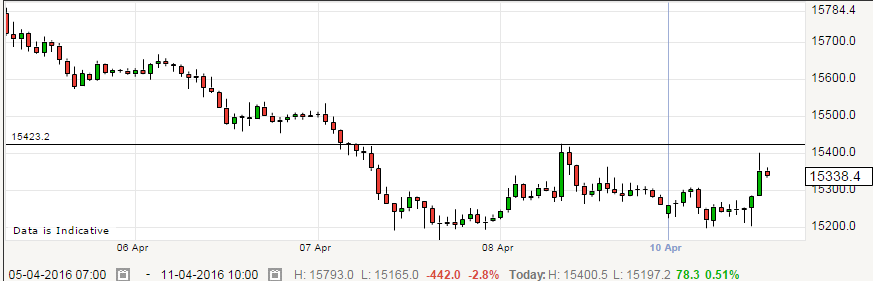

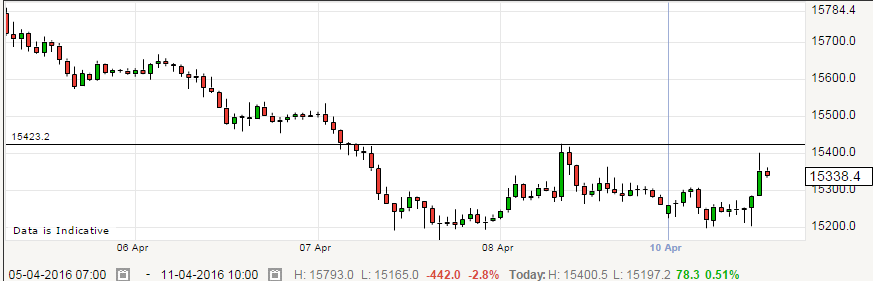

The key thing to note is that flows have no trend per se and indeed can often have little to do with the prevailing trend, often correcting recent moves. That's been the case with GBPJPY which has seen steady falls but this morning saw a sharp and rapid reversal from 152.00 to 154.00 after recent falls from 157.00 to 151.65. Flows are on-going and occur when a corp or trading desk have something to cover or instigate.

"Go with the flow" is a mantra oft spoken/preached and I stand by that but in the case of a large order like we saw earlier then you have to judge how much mileage there is left by the time you jump on. Get in early and you can enjoy the ride. Get in late and you're left adrift and struggling. As always, info is king and you're not always going to know so how else can you judge the momentum?

Orders/flows vary in size and their impact will depend not just on size but also the prevailing liquidity as well as the element of surprise. This morning's orders caught the market off guard early in the European trading day and against the prevailing softer trend but yes, will have been of very large size too.

The knock-on impact can/will be seen across other related pairs as the GBPJPY order will ultimately find its way into the core pairs. Hence GBPUSD orders around 1.4150 were filled and then more at 1.4180 triggering stops which then took out the supply into 1.4200 before finally exhausting itself into the next tranche at 1.4230.

EURGBP didn't/couldn't ignore the impact and had its own wobble through 0.8050 demand to post 0.8005 ahead of strong support/bids at 0.8000. Meanwhile USDJPY made its way in rapid time from 107.85 to 108.28 before running into fresh supply at 108.30.

So, lo and behold, we're back to 1.4185, 0.8025 and 108.06 proving on this occasion that patience was a virtue if you are a rally seller on GBPUSD and USDJPY or dip buyer on EURGBP. Forex markets aren't rocket science as I frequently point out here and for me flows highlight both the simplicity and the speed at which markets can and will operate.

Likewise the technical analysts amongst you will sometimes welcome the opportunities they provide whilst scratching your head as to the cause. Understand though that flows and orders are fundamental to the very core of price action, albeit sometimes led by techs too.

So next time it happens dear reader have a think about how you're going to play it. Sometimes you'll hit the extremes to your advantage and that's great, but rare. Mostly you will find yourself drawn into tranches of selling or buying while being curiously unaware of why the moves are happening. In those cases you will invariably have to suffer some pain but, when it's order/flow based, as we revealed here earlier rather than something more earth-shaking, patience will invariably bring its own reward.

As always we welcome further questions in the comments section below.