It's all in how you approach your trading

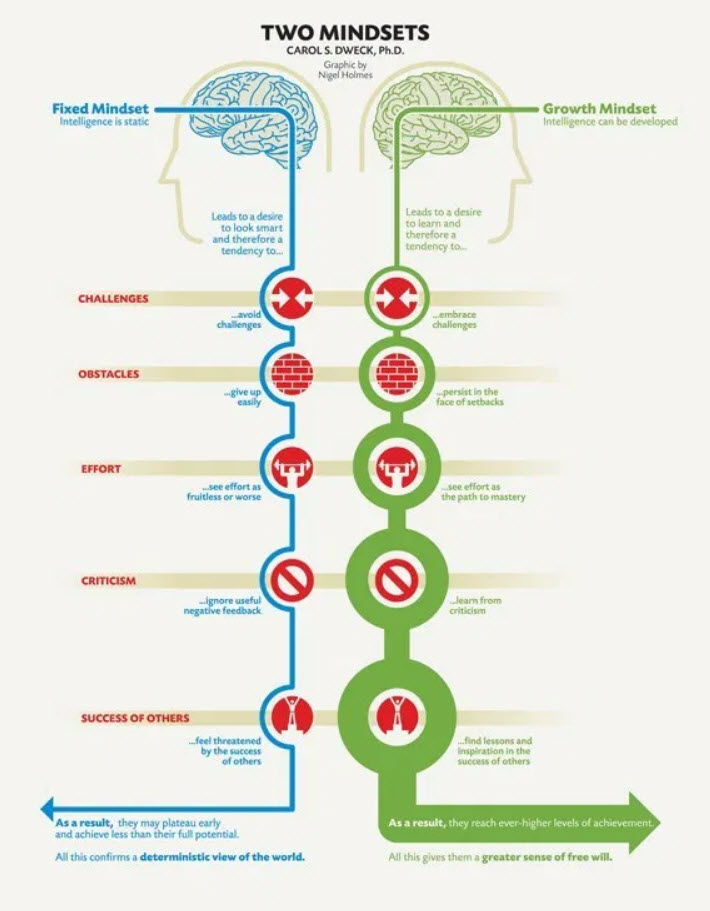

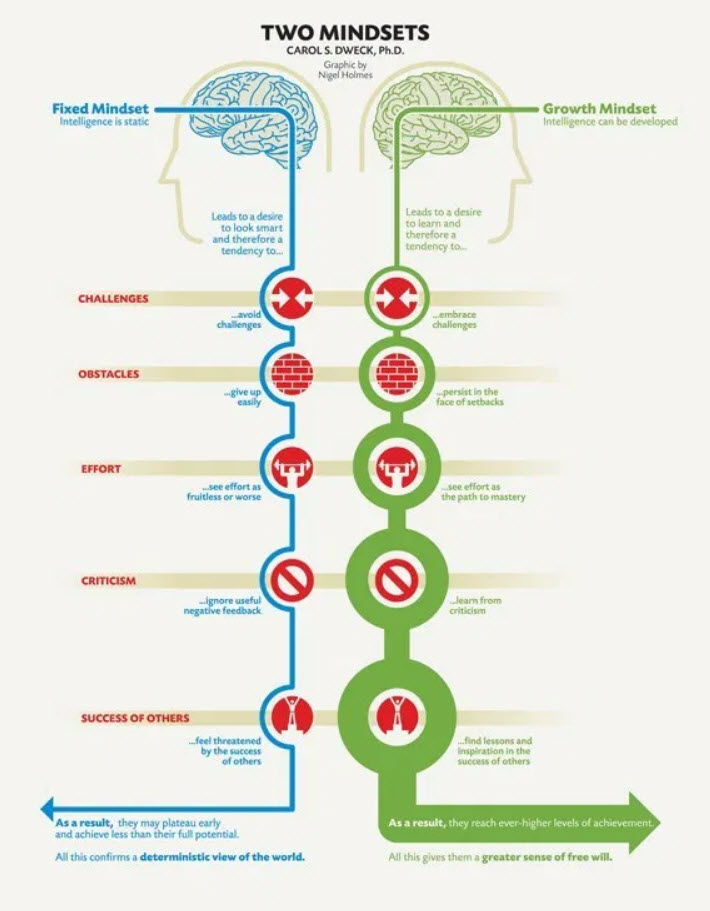

In her book "Mindset: The New Psychology of Success", Carol Dweck characterizes people in two general buckets.

- Fixed mindset

- Growth mindset

The FIXED MINDSET person:

- Looks at CHALLENGES and avoids them

- Gives up easily when OBSTACLES get in the way

- See EFFORT as fruitless or worse

- Ignores useful negative feedback or CRITICISM

- Feel threatened by the SUCCESS OF OTHERS

In contrast a person with a GROWTH MINDSET:

- Embraces CHALLENGES

- PERSISTS in the face of setbacks

- Sees EFFORT as the path to mastery

- LEARNS from criticism

- Finds LESSONS and INSPIRATION in the success of others

In things we do in life, we have a choice whether we want to have a fixed mindset or growth mindset.

It was Valentines Day yesterday, so lets take a look at a relationship.

When married to someone, you will run into a CHALLENGE like school choices for your children. You may want to home school them, while your spouse wants to send them to private or public school. You can ignore that challenge or have a discussion about it, analyze the costs and benefits and embrace the CHALLENGE.

You might have a OBSTACLES like not being able to afford private schooling for your child. You can give up and just accept the less desirable alternative plan, OR you can persist and find ways where you may be able to make it happen by cutting back on eating out, bringing your lunch to work, delaying the new car purchase (or get something less luxurious), search out scholarships and/or find other ways to save the needed money to make your preferred choice for your children a reality.

You might see making the EFFORT to solve the inevitable marriage problems as fruitless, OR you can instead see the EFFORT of making the ebbs in a marriage a chance for renewal of your love for each other

You may choose to get angry at your spouse for useful CRITICISM of your driving habits, or you can take a step back and LEARN that maybe it does not make sense to speed or tailgate with your children sitting in the back seat.

You may choose to take the "team" out of your marriage and instead make everything a competition full of resentment toward the spouses successes, or you can get INSPIRATION and joy from your spouses success and share the victories even if it requires a sacrifice on your part.

Traders also have a choice when it comes to having a fixed or growth mindset.

Do you take the easy road or embrace the hard challenging road?

Trading is a CHALLENGE. It may be the hardest thing you ever try to do - even harder than marriage ; ).

There are so many variables that go into becoming a successful trader. Yet I have seen so many traders take the easy way, and do things like buy a overpriced signal service, or take some randoms persons trade recommendation from twitter without understanding the "whys", risks and even the experience of the person you are getting the advise from.

I know we at Forexlive may fall into the category of a "trade advise giver". However, I know whenever I or my colleagues at Forexlive recommend a level to trade, we will always either spell out "why" fundamentally or technically, define the risk and show and verbalize the next targets (or do all of the above).

Personally, since I am focused on the technicals, I go to great lengths to not only give details in the post, but mark up the charts with comments, arrows, yellow areas, circled numbers so that you can easily envision why "this level" is so important to me (and potentially you too).

However, the CHALLENGE to you is to understand the process of what it takes to become a traders and embrace that challenge. My greatest wish is not that you take our advise as gospel, but for you to embrace the challenge to learn from what we write, process and ultimately "fish for yourself" by using our bait.

Do you give up easily when OBSTACLE get in your way or do you persist in the face of failure?

Trading is so humbling. There are doctors, lawyers, top leaders in business, who likely got straight A's in school and quite frankly failed very little in their lives. They are blessed with the intelligence to learn and excel in learning. Yet they try to trade and find the OBSTACLES immense.

Trading is a discipline where all types of random variables are thrown at you that cause the price to go one way, when you knew for sure it would go the other way (given another set of variables). If there is a profession where there are more obstacles, I am all ears to hear which one it is.

If you CAN NOT learn to accept failure in trading, a trend move against your position will take care of you in short order.

Having the growth mindset to not only accept failure but persist when the trading gods throw you a curve ball, is essential to be successful as a trader.

Do you see effort in your knowledge growth as a trader as fruitless or do you see the effort toward learning as a path to mastery?

I am not sure even the best trader in the world ever feels like they completely "master" trading. We ALL fail. However, those failures need self reflection and a desire understand the error in your ways.

When I say this, I don't mean to imply that every little 5 or 10 pip loss needs a full CSI investigation. As mentioned, we all will lose.

However, there are times when we really do something that is more of bigger "trading sin". It is those trades that we need to learn from, and increase our knowledge of what to do and what not to do.

Most of the times, you may already know the error in your ways (i.e. ignored my stop. leveraged too much or traded when the risk was just too high). However, if you are going to move toward mastery, you need to learn from mistakes and increase your knowledge.

What about reading book after book on trading. Will that make you a better trader?

Growth mindset people in many disciplines can indeed master their subject by absorbing more and more information from other experts. Medicine and technology advancement are disciplines that growth mindset people can master more and more with more and more knowledge cramming.

So can it be done in trading?

Needless to say, there is loads of money being spent on AI trading, or developing new models that will gather reams of data and spit out a bias, a trade, that will make fortunes. Their system will defy the market. It will BE the market. Is that realistic?

To me only if you can literally take your money and MOVE the market price. Why? Because what your model says may not be what the model of someone BIGGER than you is saying. If you are a weakling as far as trading capital, you will be manhandled by someone bigger than you 100% of the time.

My feeling is that there comes a point where traders (especially retail) have an information overload or can reach a point where the marginal cost far outweighs the marginal benefit. In fact, too much information can do more harm than good as you reach a point of "analysis by paralysis".

Having said that, many traders think this game is a 50-50 proposition and that because they had a hunch the EURUSD was going up - and it did - that the same hunch will work tomorrow and the next day and the next day. Trading is not about hunches and the thrill of the quick victory.

There are things that ALL traders need to understand and learn if they hope to be successful.

I like to think my book "Attacking Currency Trends" (4.5 stars out of 5 on Amazon) gives traders the foundational knowledge to move toward "mastery" as a trader.

Following the posts on Forexlive.com is knowledge growth that you can learn from, and will help toward mastery. That is not to say that what we say goes 100% of the time, but what we say/post is as factual and supported, and as timely as we can possibly be. It can as a result, be the basis for your opinion/analysis/trade.

Be aware that it is important to have a growth mindset of knowledge in your trading,but there may be limits too.

Do you ignore useful NEGATIVE feedback or LEARN from criticism in your trading?

Trading is a lonely game. Typically, it is you vs. "the market". So feedback does not come from a nagging spouse or even a boss for most traders (although some traders do in fact have bosses that may give negative feedback).

Having said that, for traders the NEGATIVE feedback comes from the profit and loss.

As mentioned there will be drawdowns in our trading accounts. However, it is important to understand when we really "sinned" in our trading by ignoring the negative feedback from a loss that keeps on getting bigger and bigger and bigger.

Most traders, with some knowledge and risk management can do ok in trading for a while. However, where the most traders disappear from trading (never to be seen again), is when they take those big counter trend hits to their P&L. I worked for many years at a retail broker and believe me, traders blow up in trending markets.

Remember trading is about you vs "the market". The "market" is reflected in the price action. If you think the price is going to go higher, and it continues to go lower and lower and lower, you are ignoring the NEGATIVE feedback that "the market" is giving you. It does not lie.

Big losses are a traders NEGATIVE feedback. Learn to understand what "the market" is telling you. If so, you will avoid those huge drawdowns that will deplete your trading account.

Do you feel threatened by the success of others or do you find lessons and inspiration in the success of others?

We are all in this game called trading together. We all put our pants on one leg at at time. No one is the master of the trading universe. However, there are those that are successful, explain themselves and who are frankly "better than you" (or me for that matter).

Now we at forexlive.com are open to criticism and rightfully so. No one is perfect in this game called trading. However, I know our job is to inform, give ideas, educate, provide a forum for trading and do it in a timely basis 24 hours a day 5+days a week. The proof our our success, is we are followed by many.

In fact, Adam sent me one of our recent followers on Friday:

I am not sure Ms Shelton (Federal Reserve nominee for those who may not know) is interested in my charts per se (although I would be honored if she had the growth mindset to understand more), but she likely will absorb information from Adam and Justin and Eamonn and grow from it. Otherwise, why follow us. She does because she has a growth mindset.

SUMMARY:

Whether it is in your relationships or trading, it is important to have growth mindset. Don't get stuck in your fixed stubborn ways that don't allow you to expand, and get better. Instead embrace these growth mindset simple principals and if you do, I am sure you will become a better trader.