A note via quantitative research at Societe Generale, expressing concerns over the US market snap back rally being way overdone.

Its occurred because:

- government stimulus provided to Americans of all income levels

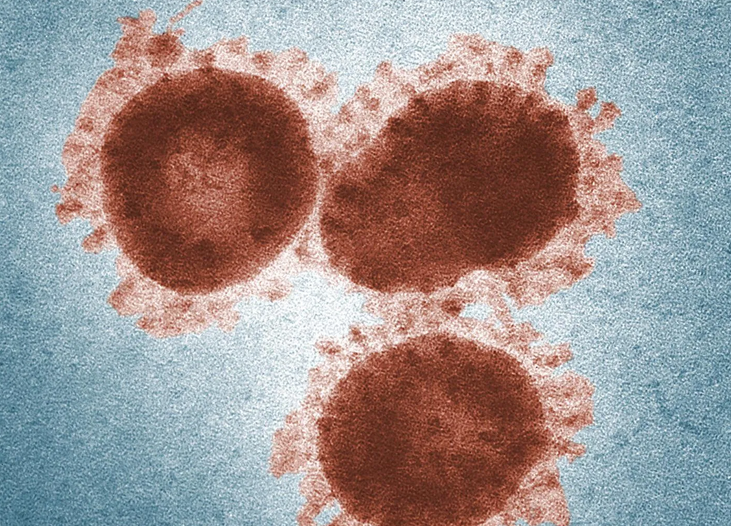

- steady reports of progress being made by pharmaceutical companies on a vaccine

SG say its likely a vaccine will not immediately be the panacea investors expect.

- "With questions on the effectiveness and wide availability of vaccines remaining, as well as the potential impacts of the pandemic's damage to the economy, there may be more downside risk from markets overshooting"

SG outline four concerns

- No guarantee any of the vaccines under development will be effective on a large scale

- No guarantee that any vaccine will be widely available,citing a study showing nearly three quarters of healthcare executives do not expect an effective vaccine to be accessible before H2 2021

- People who will not get vaccinated (eg anti-vaxxers or those worried about the safety of the vaccine) may slow down the process of ensuring herd immunity

- It will take some time for people to return to pre-COVID behaviour even after a vaccine is available. Eg. taking public transport, attending social events and gatherings

Pessimistic sum-up:

- "The long-term deleterious economic after-effects of pandemics could span multiple decades"