What's coming up

I can hardly contain my excitement about yesterday's set of Markit US PMIs. It's not just the turn for the better in the economy, it's that the market reacted in a big way to economic data. That hasn't been the case for ages and it's only one data point but it would be a welcome return to a playing field that's not all politics, the pandemic and central banks.

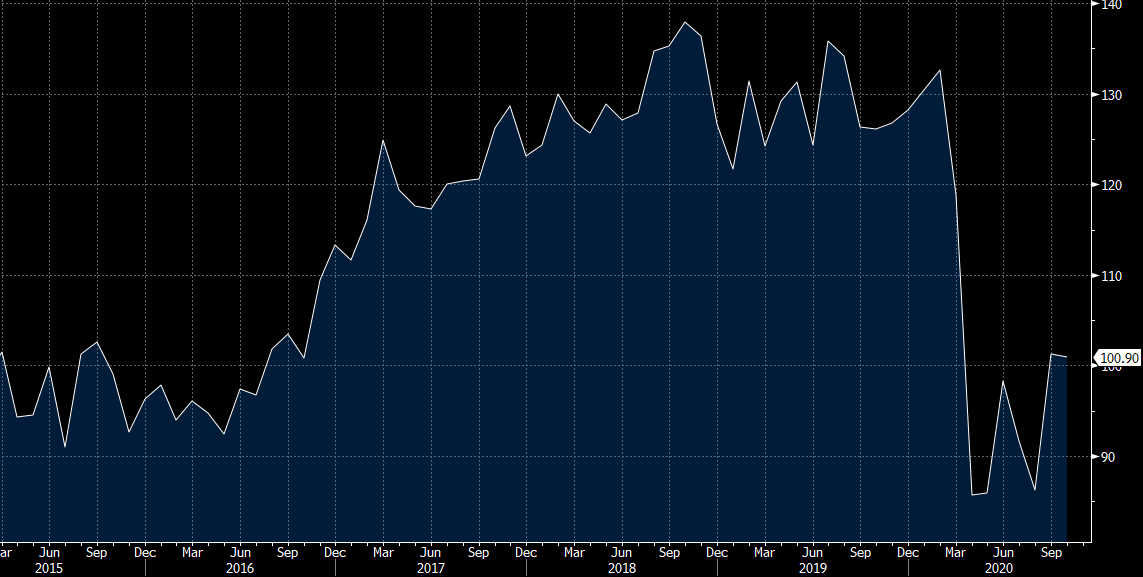

Today we get another forward-looking survey but this time it's on the consumer. The 1500 GMT Conference Board survey could have a similar effect on the market. It 's forecast to dip to 97.9 from 100.9 at 1500 GMT.

The Richmond Fed is due out at the same time, amid mixed recent manufacturing data.

Housing data is also on the agenda but it's the lower-tier variety with the FHFA house price index and the 20-city measure from Case-Shiller.

In terms of central bank speakers, it's busy with: the ECB's Lagard, Fed's Bullard, Fed's Williams, the BOC's Wilkins, ECB's Lane, the Fed's Clarida and ECB's de Cos.

Seven-year notes are on the auction block.