Some key developments yet to play out in the trading day ahead

The dollar is mildly weaker in trading so far, but major currencies aren't really running away with things though we are seeing modest moves with USD/JPY keeping just under 105.00 and cable approaching the 1.3000 handle.

Gold and silver aren't doing much and equities are pretty much stalled as we wait on the Fed for more clues in the day ahead. So, what are the things to watch out for?

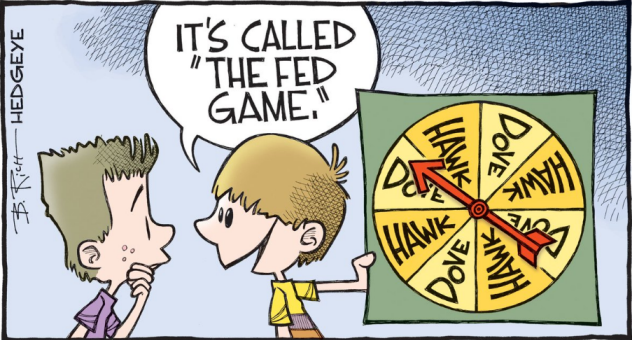

FOMC meeting

The Fed meets once again today but are likely to reaffirm a more wait-and-see message, after having announced that they will extend most of their emergency lending programs through to the year-end; they were set to expire on 30 September.

The fact that they went out of their way to announce it outside of their policy decision reaffirms expectations that they want to keep things clean and simple later on today.

They are almost certainly likely to maintain the narrative that they will do what they can to support the economic recovery, but are pretty much sidelined for the time being.

More talk on US stimulus measures

US lawmakers are still butting heads on this issue and the longer they take, the more it may spark jitters in the market. That may be part of the story as to what is keeping markets more cautious and tepid over the past two days as well.

The latest on this is that the proposal by GOP lawmakers is unlikely to gain approval in the House, not to much surprise really.

That just means negotiations will continue for some time yet, with some stimulus measures set to roll off starting from the end of the week. As such, the next few weeks will be interesting to see how the US consumer copes with the ongoing situation.

Earnings, earnings, earnings

It is a big week for earnings in Wall Street with the likes of Boeing and Facebook reporting today. Tomorrow will also be key with both Apple and Amazon set to report after the close but we will also see the likes of AstraZeneca, Ford, and Alphabet on the agenda.

The market has largely braved through the latest earnings season without much of a hitch and are likely to keep that tone into the weekend. But just be mindful in case of any major surprises that could tweak the narrative alongside month-end flows this week.