GBP/USD is trading 1.5667 after failing at 1.5700 and the top comes in 111 pips from the low. If you were long from the bottom you should be sitting on a nice position and are able to lock a good chunk of it in, if you so wish.

If you were to have chased the trade you wouldn’t have beaten the algos to 1.5640/50, so that would have been your first entry point. If you didn’t take profit up at 1.5700 then you’re now worried that the price is only 20 odd pips away and you’ve only got a little bit of wiggle room to play with for the rest of the day.

In this case I’m obviously only talking about the current price action following the BOE minutes, not what will happen in the next hours/days/weeks.

Having a plan for every trade is of utmost importance, even if you’re trying to catch a quick move. Know your levels and what needs to be broken so you can maximise the profits and not turn a good trade into a bad one.

Chasing trades is not something I like to do. Yes you can miss out on a big move but there will always be another one right around the corner. Keep to your disciplined plan and you’ll make them count.

Where does the pound go now?

We need confirmation that this pop is sustainable and the 1.5660 level is going to be key to that, followed by 1.5640 then 1.5620, 1.5600/10. Above, 1.5700 is the big target but the fall below 1.5680 will likely see it play resistance too.

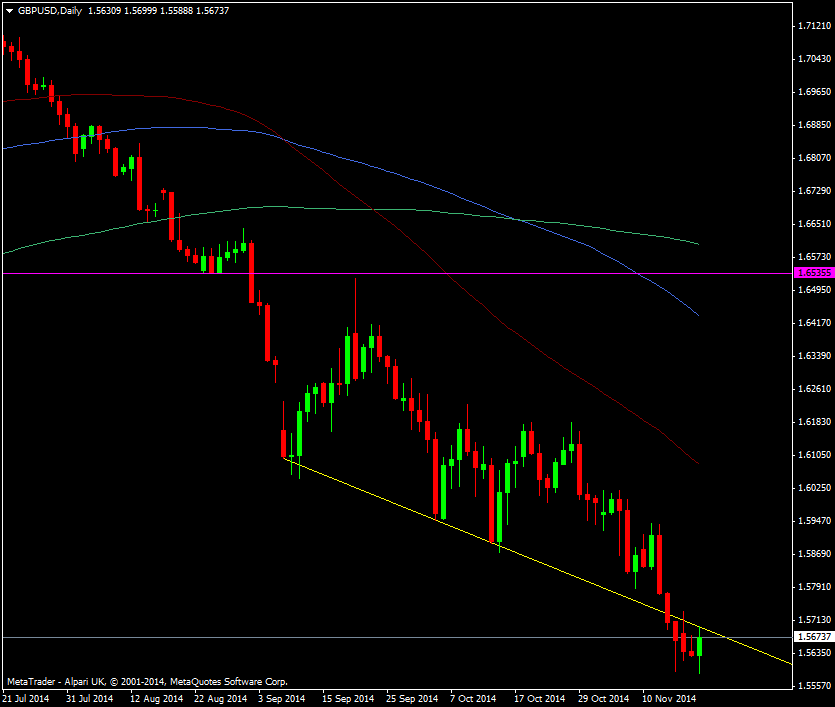

GBP/USD Daily chart 19 11 2014

The BOE move is over so we’re back at the mercy of whatever else transpires today. First up for that is US housing starts and building permits.