ANZ see "No bear market for gold", with targets in the 0 - 3 month horizon at USD 1,900/oz.

- and a 12-month target of USD2,100/oz

Some comments from analysts on reasoning:

- prospects of an imminent coronavirus vaccine, the likelihood of a strong global recovery and a rally in risk assets continues to improve ... could take some shine off from gold’s haven appeal, we don’t think it will scuttle gold’s current rise.

- in the bull market of 2002–07, when the S&P 500 index rallied more than 75pts, gold surged 125% to USD750/oz.

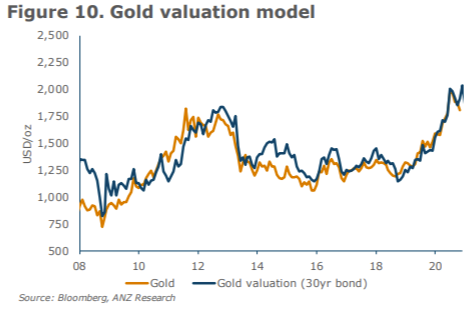

- Our gold valuation model suggests current prices are undervalued, while comparisons with copper and oil confirm this.

- We believe gold’s other main drivers, real interest rates and the US dollar are likely to provide support over the coming year. Using the US Federal Reserve’s forecasts for rates and inflation, real rates should continue to push into negative territory. And a strong global growth pulse should see the USD weaken further.