ANZ on CFTC - highlight that Leveraged funds were net USD sellers for the eighth consecutive week

In Summary:

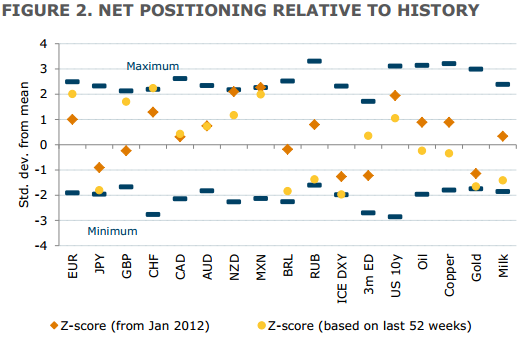

- Further reducing their net long USD positions

- Brought the overall net USD longs to their lowest since May 2016

- Net long ICE USD positions, which mirror the DXY, were at a three-year low

- With dovish remarks from Fed Chair Yellen and weak CPI and retail sales prints last week, long USD positions are likely to have retreated further

- Dollar selling was broad based against the G10 currencies except the JPY

- Funds were most bullish on commodity currencies. This was led by CAD ... Meanwhile, AUD and NZD saw further net buying

- Funds unwound their net short EUR positions by USD1.4bn to turn net long ahead of the upcoming ECB meeting

- net long 10-year UST positions were cut for the third successive week, as yields continued to head higher

--

Note- ANZ look at the US Commodity Futures Trading Commission (CFTC) data a little differently to others - I have an explainer here