A snippet from the latest from ANZ on oil, in brief:

- OPEC+ is sticking with its production cuts deal

- production is falling in Iran and Venezuela and risk of supply disruptions is rising in the Middle East

- Together these should see the oil market balance tightening in H2 2019.

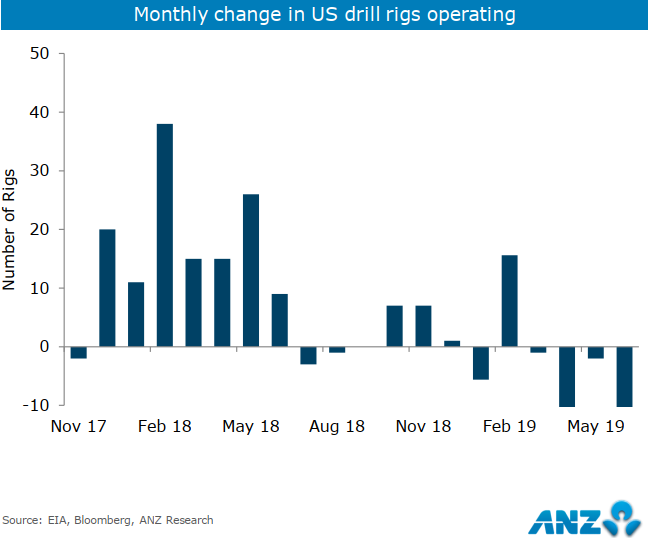

- US shale companies have been pulling back on drilling, could limit growth in output from shale in near term.

- Slowing global economic growth will still see demand growing more than 1mb/d.

- We believe the market's focus will soon shift from a focus on softer demand to looking at supply disruption risks. This should see prices back above USD70/bbl in H2 2019.