Economists at ANZ in NZ

- post-lockdown bounce in high-frequency indicators continues, including a strong pick-up in the PMI and PSI data

- In isolation, these point to a vigorous bounce in near-term GDP, but there are some conflicting messages when the full suite of economic indicators is considered together

- The housing market has also seen a bounce as lockdown has ended, due partly to low mortgage rates and temporary supports. We expect that house prices will fall 5-10%, with a sharper correction now looking more avoidable

- Commodity prices remain resilient and dairy returns are in a stronger position as new-season milk starts to flow, though we expect dairy prices to ease later in the season. We have upgraded our farmgate milk price forecast for the 2020-21 season to 6.50/kg/MS.

- The solid near-term bounce in activity, resilient commodity prices and a better housing outlook are helping to temper some of the downside risk we see to our forecasts. We now see risks to the GDP outlook as balanced, though the bands of uncertainty remain wide.

- (bolding mine)

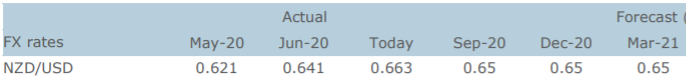

NZD forecasts: