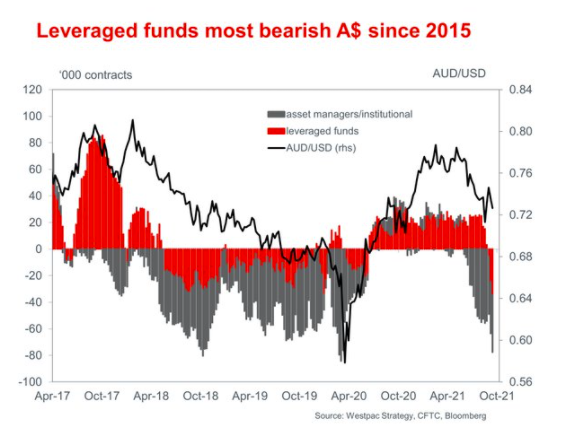

Via Sean Callow at Westpac a heads up on what do seem to be extreme levels of AUD shorts.

Remarks:

- Leveraged funds on CME continued their turn against A$, extending net shorts to -34.4k contracts in week to 14 Sep (spot 0.7320) from -24.7k.

- Asset managers extended net shorts to -43.2k from -38.7k.

- Combined position of -77.6k, face value -A$7.8bn is similar to Mar 2020 panic

AUD/USD is on its lows for the session as I post, AUD lower on what are a number of factors but most obviously the Evergrande woes being expressed in a big slide in HK equities today - AUD a 'proxy' trade for China playing out during the session and lower also.

There are plenty of other potential narratives for AUD weakness ... but if you are short AUD do be aware its a popular position according to these CFTC numbers. Crowded trades can precipitate shrp reversals.