Coming up at 0130GMT (Wednesday 4 April 2018), but taking a back seat in terms of interest to the retail sales numbers (preview of retail sales here) ... February building approvals

Previews:

ANZ

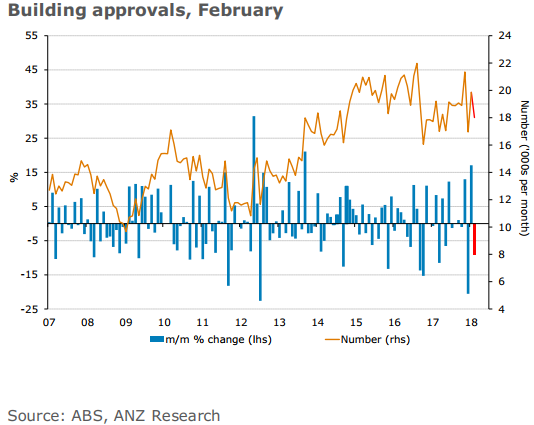

Recent volatility (exacerbated by lumpy approvals numbers due to units in Victoria and New South Wales) continued, with building approvals increasing 17% m/m in January.

- This was much higher than market expectations.

We expect there to be payback in this month's data and for there to be a significant fall in approvals.

- Despite the expected drop, we continue to see a positive outlook for both trend building approvals and construction activity over the near term. This will be supported by ongoing strength in housing finance for the construction of new dwellings.

via Westpac:

The January dwelling approvals report came in well above expectations with a 17% jump driven, once again, by extreme swings in the lumpy 'high rise' segment (+60% in Nov, -47% in Dec and +36% in Jan).

- Approvals outside of high rise have been more mixed, private detached house approvals down 1.1% but 'mid rise' dwellings up about 15%.

- On a combined basis, total approvals ex high rise were up 2.9% nationally and 7.2%yr.

Housing finance data continues to point to modest gains in non high rise approvals, albeit with the trend showing signs of softening.

- High rise is much harder to call.

- Site approvals continue to point to the segment taking another leg lower after the weakening in the first three quarters of 2017.

- Note also that despite the big lift in Jan, high rise approvals were coming off a very weak Dec read.

- On balance we expect total approvals to retrace 4% in Feb but clearly extreme monthly volatility puts significant risks around this estimate.

NAB:

- NAB expects that February approvals will reverse some of the strength in January (-4.9% mini, -1.7% y/y), to confirm a relatively flat underlying trend

- Approvals data have softened from the 2016 peak, consistent with evidence from other housing market indicators that the heat in the market is gradually leaving.