National Australia Bank monthly business conditions and confidence data, for June 2019.

- Due at 0130 GMT on July 9

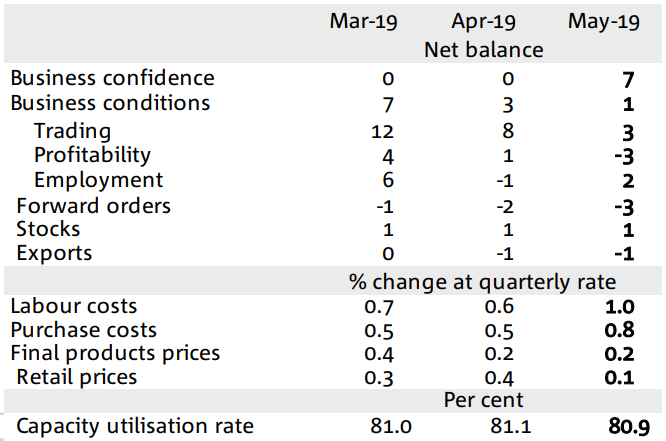

- priors 1 for conditions and 7 for confidence

The May 'confidence' result was a 7 point jump, reflecting the election result (and even that there was one … ie we weren't kept waiting with fears of a hung parliament). The result, though, while welcome, at 7 its barely above its longer run average. May 'conditions' hit their lowest since 2017. (more on the May survey results here)

For June - this survey will be post the June RBA rate cut (should be a positive) and also any continued impact from the election. Media coverage at the time was positive for the housing market, the return of the incumbent government was seen as a positive for this. On the other hand there was also speculation of delays on the government's income tax cuts around that time. While there is no survey conducted for expectations from the NAB Business Survey the anecdotal reports I have seen are indicative of analysts expecting further improvement.

Do note that while conditions and confidence are the two headlines in this report attention will turn quickly to the 'employment' sub component. This index improved a touch in the May survey:

Despite its improvement it hasn't shaken loose a year long down trend.