There is no change in the rates expected from the RBA today. The announcement and Statement come at 0430 GMT on 03 April 2018.

- I posted earlier: AUD traders - RBA announcement due today - preview

More now ...

Preview via NAB:

- firmly expected to result in no change in the cash rate, given RBA communication has consistently emphasised the need to see further progress on reducing spare capacity in the labour market and on wages/inflation

- Of greater interest for markets will be the post-meeting Statement

- Since the March Board meeting, the Bank has been able to digest Q4 GDP numbers and February jobs data, both of which have given mixed readings on the economy-markets will be looking out for the RBA's interpretation of these figures.

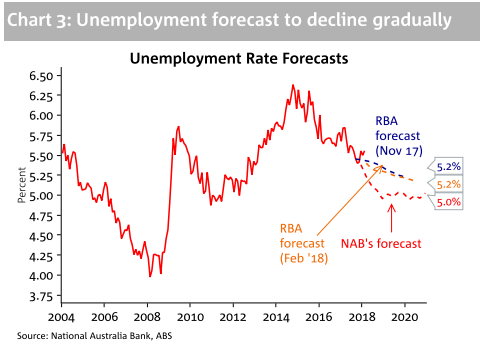

- In particular, markets will be seeking to understand how the Bank is reading the labour market-the past year has seen record jobs growth, but the unemployment rate, at 5.6%, remains stubbornly above estimates of full employment (around 5%).

- While employment has been surging, greater participation has kept the unemployment rate elevated. While this is certainly not a bad thing, the labour market slack is not reducing much.

- As such, markets will look for any sign that this will prompt the RBA to rethink its already modest outlook of a gradual improvement in unemployment

More, this via:

BofAML:

The Reserve Bank of Australia is firmly on hold

- we expect no change of policy at the board meeting on 3 April

However, we will get some more insight into whether the recent rise in short-term funding rates is seen as an unwelcome tightening of financial conditions.

- We do not think so at this stage, but this is a clear transmission of higher global rates into the domestic economy irrespective of the RBA's stance.

Inflation and wages will dictate when the RBA moves to a less accommodative stance.

RBA pricing that has pushed the first hike out to mid-2019 fails to reflect risks that labor market strength will translate into higher wages over the year ahead. We question how much spare capacity there is in the economy.

There has been little market reaction to rising trade friction between Australia's largest trading partner and closest ally, even though AU rates are now below the US for the first time since 2000.

- The resilience of AUD to escalating trade tensions may be related to the fact that the bulk of Australia's exports to China are used in domestic non-tradable investment (property and infrastructure) rather than part of the supply chain for China's exports to the US.

(bolding above is mine)