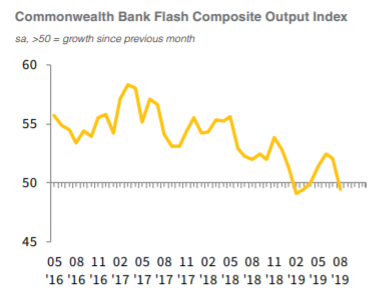

CBA / Markit preliminary PMIs for August

- Manufacturing 51.3 vs. 51.6 in July

- Services 49.2 vs. prior 52.3

- Composite 49.5 vs. prior 52.1

Weaker across both services and manufacturing (and therefore composite also)

CBA/Markit cite the key points:

- first reduction in output since March

- decline centred on the service sector

- New orders also decreased

- employment returned to growth

- business sentiment picked up

CBA Chief Economist, Michael Blythe:

- "A persistent concern is that the fallout from the US-China trade war will dent global capex and consumer spending as cautious businesses and households retreat to the sidelines. The shift back into contractionary territory in the CBA Flash PMI reading for August indicates that Australia is not immune to these global risks. The concerns about weak output readings are tempered a little by positive indications on the labour market and future business expectations."

- "The challenges faced by the RBA in their attempts to return inflation to the 2-3% target band are also highlighted in the survey. The lower Aussie dollar is putting upward pressure on input prices. But the competitive trading environment is limiting the flow through to output prices."

---

If the preliminary results carry through to the final ones, due from September 2 (when we'll also get AiG PMIs starting to come in for August) they'll not be much of a positive.