Australia Nov commodity index data now out 1 Dec

- prev revised up from 120.9

- increase of 1.6%

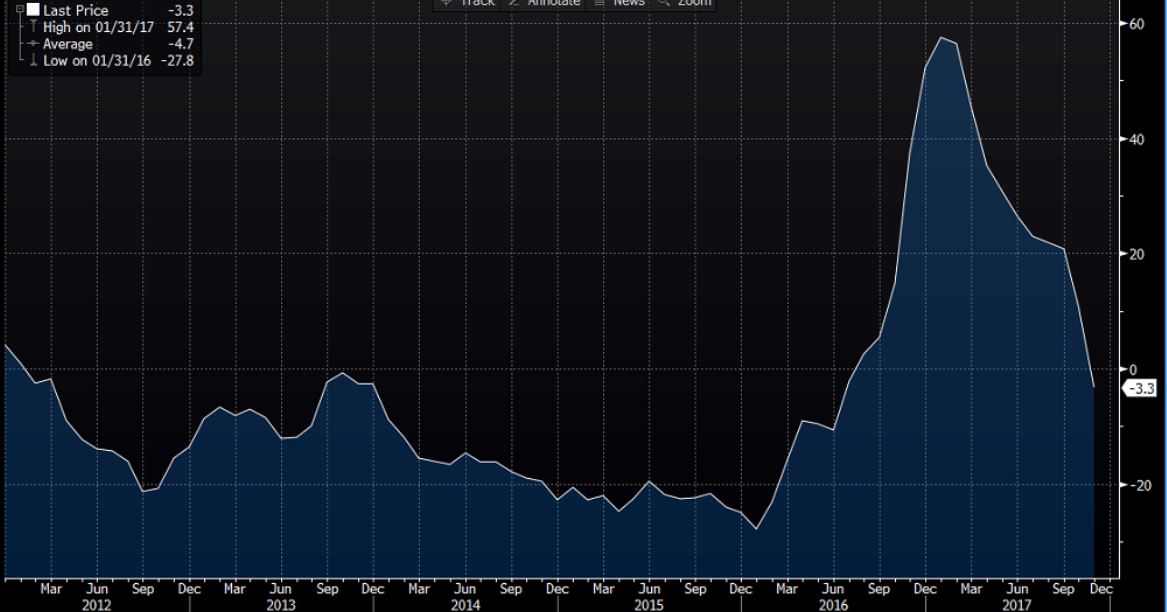

- SDR terms yy -3.3% vs 10.9% prev revised from 9.1%

- falls led by lower iron ore

Says the RBA:

- Consistent with previous releases, preliminary estimates for iron ore, coking coal, thermal coal and LNG export prices are being used for the most recent months, based on market information. Using spot prices for the bulk commodities, the index increased by 2.2 per cent in November in SDR terms, to be 14.1 per cent lower over the past year

Full report here

Commodity Prices measures the change in the selling price of exported commodities. The commodity sector accounts for over half of Australia's export income.A higher than expected reading should be taken as positive/bullish for the AUD, while a lower than expected reading should be taken as negative/bearish for the AUD.

AUDUSD currently 0.7562 tightly bound after falling again from 0.7600. Demand/support into 0.7550 still