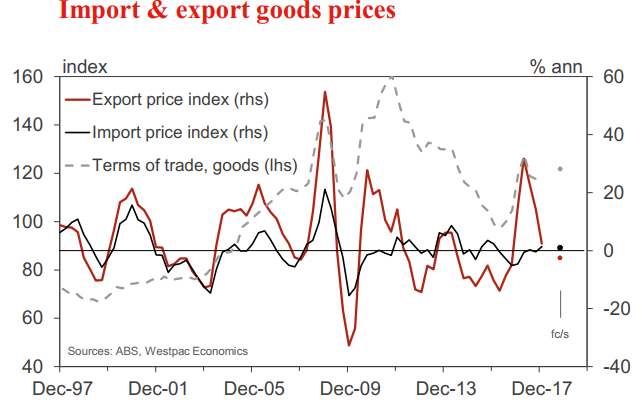

A preview of the Australian Q1 terms of trade data due today. ToT has been improving.

But, weighing on the AUD is a checklist of woe .... UST yields rising relative to Australian, high household debt and slow wage growth weighing on consumer spending domestically, trade frictions perhaps impacting on China ..... and the list goes on.

Today we should get another improvement n the term of trade

- Import price index expected +1.2% q/q, prior +2.0%

- Export price index expected +4.1% q/q, prior +2.8%

Improvements in export vs. import prices are important for the GDP calculation - 'net exports' is added to GDP.

Westpac have a more detailed what to expect:

Prices for imported goods increased by 2.0% in the December quarter impacted by the lower currency in the period. Over the 2017 year, import prices lifted by a modest 1.4%, boosted by higher global energy prices.

- For the March quarter of 2018, we expect a 0.8% rise in import prices, with the annual change moderating to 1.0%.

- The currency slipped in the quarter on a TWI basis, declining by 0.7% to 64.2, some 2.7% below the level of a year ago. In addition, the bill for fuel imports rose in Q1 as global energy prices increased a little further in the period.

Export prices moved higher late in 2017, +2.8% in Q4, after a mid-year slump, -5.7% in Q2 and -3.0% in Q3. For the 2017 year as a whole, export prices rose by 2.4% to be 24% above the low at the start of 2016, reflecting the rebound in commodity prices, up from historic lows.

- For the March quarter, export prices are expected to increase by 3.7% supported by higher commodity prices in the period. Despite this, export prices would still be 2.5% below the level of a year ago.

- The terms of trade for goods, on these estimates, increased by almost 3% in the March quarter. That still leaves the index 4.5% below the level of a year ago.

- As to prices for services, an update will be available with the release of the Balance of Payments on June 5.