Due at 0130GMT from Australia, Housing finance data for February

- Home loans expected -0.4% m/m, prior -1.1%

- Investment lending prior +1.1%

- Owner occupier lending, prior +0.5% m/m

I posted a preview a little earlier, here

This preview now via Westpac

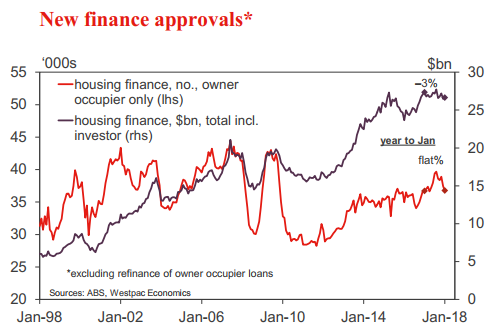

Australian housing finance approvals had a mixed month in Jan, the number of owner occupier approvals dipping 1.1% but the value of investor loans firming 1.1%. As always, housing data should be treated with extra caution around the summer holiday low period.

Industry figures suggest Feb saw a similar dip in owner occupier approvals - we expect a 1.0% decline.

It's difficult to envisage further gains in the value of investor loans although that would help explain the recent firming in total housing credit growth (i.e. the stock of debt outstanding, changes in which relate to both new loans and repayment behaviour).

---

Given all the cross-currents at play for the AUD I donltdon't expect this data to have too much immediate impact (barring a shock, of course)