I posted a preview of the CPI data coming up here already (this via ANZ)

As a reminder, due Tuesday April 2 at 0130GMT

Another preview now, this via TD:

- The bank forecasts 0.5% q/q increase for the 'trimmed mean' and 'weighted median' (core inflation measures)

A 0.5%/q increase in the trimmed mean leaves the annual rate at 1.8%/y and combined with +0.5%/q for weighted median we see overall annual underlying inflation remaining unchanged at 1.87%/y. As this print is consistent with the RBA's target of 1¾%/y for 2018, it leaves the Bank now waiting Q1 wages, released 16 May.

Also, this via Capital Economics:

- We estimate that both headline and underlying CPI inflation stayed just below the RBA's 2-3% target range in the first quarter, which will probably be a reoccurring theme throughout the year.

- may have been a little more upward pressure on non-seasonally prices than is usually the case in the first quarter of the year if retailers compensated for the heavy discounting provided on clothing and electronics around Black Friday in November.

- prices will also have been boosted by the hikes in utility prices in Victoria on 1st January and the nationwide 1.8% increase in university fees.

- Petrol prices probably also rose by around 2.0% q/q.

- intense competition may have led to another fall in food prices

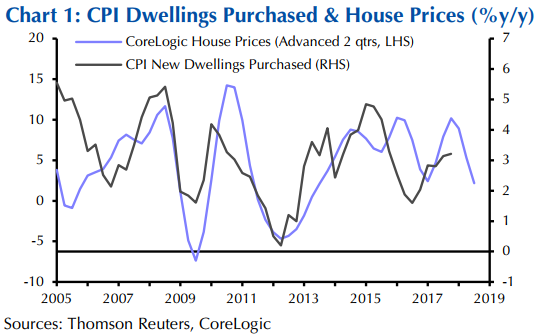

- recent decline in house price inflation points to an easing in the upward pressure from purchases of new dwellings. (See Chart 1.)

- A 0.5% q/q rise in total prices would leave headline inflation at 1.9%, while a 0.5% q/q gain in underlying prices would nudge down underlying inflation from 1.9% to 1.8%.

Barclays:

- Higher food, fuel costs likely pushed up headline inflation slightly,

- but underlying inflation remains modest, in line with regional trends around wages and modest retail sales.