Highlights of the Bank of Canada rate decision

- Prior was 0.25% (this is the effective lower bound for Canada)

- BOC pledges to keep rates at 0.25% until inflation target hit

- BOC to continue $5B per week in QE; repeats buying will continue "until the recovery is well underway"

- BOC stands ready to adjust its programs if market conditions warrant

- Says economic decline "considerably less severe than the worst scenarios presented in the April MPR"

- BOC sees 40% of activity recovered in Q3 but then "the Bank expects the economy's recuperation to slow as the pandemic continues to affect confidence and consumer behaviour and as the economy works through structural challenges"

- Central scenario in in MPR shows economy not likely to return to pre-COVID levels until 2022

- Sees 2020 GDP down 7.8%, up 5.1% in 2021 and up 3.7% in 2022

- Says Q2 activity estimated to have fallen about 15% below its level at the end of 2019, economy appears to have bottomed in April

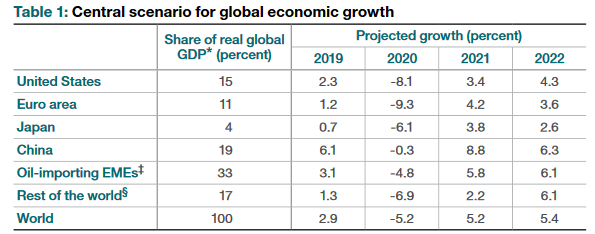

- Sees US GDP down 8.1% in 2020, up 3.4% in 2021 and up 4.3% in 2022

- Global GDP forecast down 5.2% in 2020 and up 5.2% in 2021

- The path for CPI in the next year largely reflects the influence of energy prices

The big news here is this line:

"The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved."

That's forward guidance indicating no hikes until 2% inflation is 'substantially achieved'. That last phrase leaves them some wiggle room but this is conditional forward guidance.

Macklem will hold a briefing at 1500 GMT (11 am ET)

Forecasts in the MPR: