US inflation data for August, along with jobless and continuing claims data from the US on Thursday 14 September 2017

- All due at 1230 GMT

For the CPI

- expected 0.3% m/m and 1.8% y/y

- priors 0.1% and 1.7%

For CPI excluding food and energy - i.e 'core' inflation:

- expected 0.2% m/m and 1.6% y/y

- priors 0.1% and 1.7%

Preview via Deutsche Bank (bolding mine):

We anticipate ... gains for headline (+0.3% vs. +0.1%) and core (+0.2% vs. +0.1%) CPI.

After five consecutive downside misses on core CPI, policymakers will no doubt be looking for signs of some firming in the monthly inflation trend.

- It is important to remember though that even an in-line core CPI figure would result in the year-over-year rate slipping a tenth to 1.6%, the lowest level since January 2014.

- In our view, the year-over-year rate of core CPI inflation may not bottom out until Q1 2018.

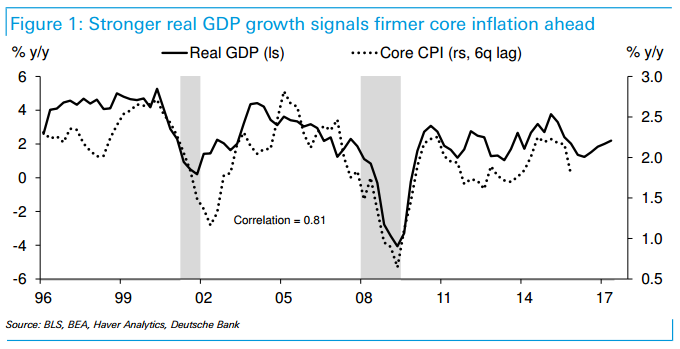

- However, with the growth outlook still very much positive, and mindful that inflation is a lagging indicator, we continue to expect that inflation will eventually begin to move back towards the Fed's 2% target next year.

- Indeed, as we can see in the chart below, core CPI inflation lags GDP growth by six quarters, so in some sense the current weakness may reflect weak growth around the end of 2015 / beginning of 2016.