The near-term sentiment in the pound continues to be driven by odds of a BOE rate cut ahead of the 30 January policy meeting

- 21 January - UK November average weekly earnings, unemployment rate

- 21 January - UK December jobless claims change, claimant count rate

- 24 January - UK January flash manufacturing, services, composite PMI

It is all about data, data, data for the pound this week. With the hot topic being a possible rate cut by the BOE, all eyes will turn towards the labour market report tomorrow and post-election PMI data later on Friday (⬆️).

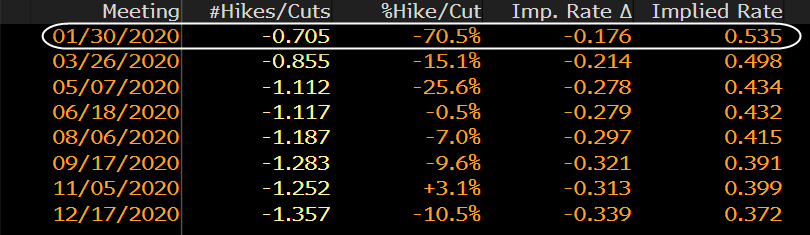

Currently, odds of a 25 bps rate cut by the BOE on 30 January sit at ~70% - a key threshold that has historically seen the central bank take action when it comes to rate decisions.

As such, the data releases this week will either give more confirmation on that or perhaps give market participants a little something to guess ahead of the meeting next week.

For the labour market report tomorrow, it is all about wages data. Inflation has come in softer recently and waning wage pressures will only serve to add to more worries about the BOE falling into an inflation trap down the road.

Given that expectation, expect significantly weaker wages data tomorrow to keep the pound offered during the week.

Later on Friday, we will get our first glimpse of post-election economic data in the UK.

Lawmakers and policymakers are hoping for the PMI releases to show some form of improvement in economic sentiment/conditions but if that doesn't deliver, expect markets to take that as a signal to keep the aggressive pricing of a rate cut next week.

Barring any major upside surprises in the data, I would expect the pound to be sold on rallies during the week. The current predicament should keep pressure on the currency but any major downside remains rather limited given how much is priced in already.

As mentioned before, the real fear for a significant push lower in the pound isn't a rate cut this month. Instead, it will be if the BOE hints at there will be more to come.