The Bank for International Settlements (BIS) released their Quarterly review over the weekend

As the title suggests (makes perfectly clear) its a review. And an accurate and succinct one it is indeed (bolding mine):

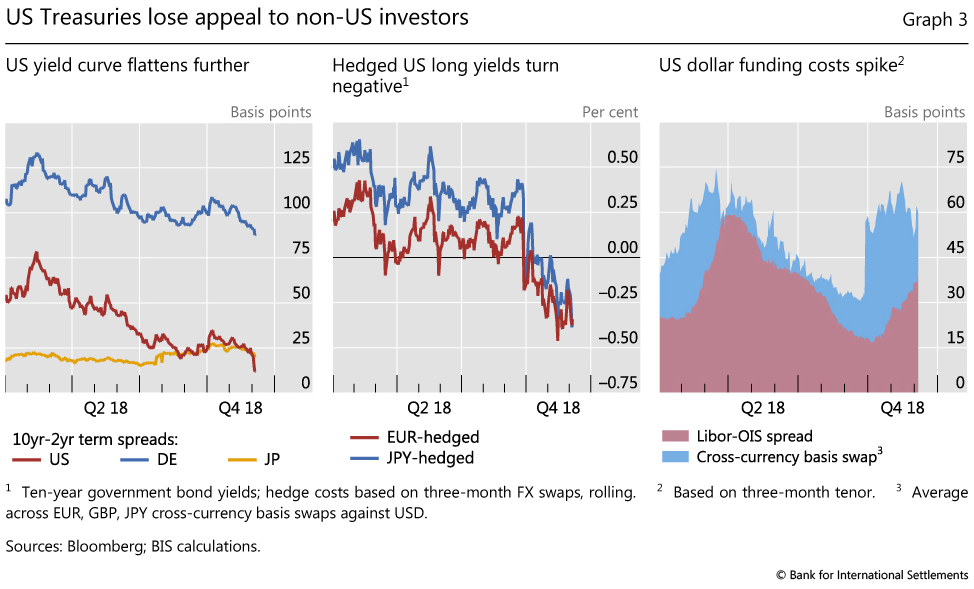

- Financial markets swung widely, eventually netting a sharp correction, during the period under review, which started in mid-September. Asset prices fell across the board and US government yields widened in October before retracing that increase and dropping further as the selloff of risk assets spread. Volatility and term premia jumped. A further round of turbulence, this time accompanied by lower yields, hit markets in December. The repricing took place amid mixed signals from global economic activity and the gradual, yet persistent, tightening of financial conditions. It also reflected the ebb and flow of ongoing trade tensions and heightened political uncertainty in the euro area. These bumps were a reminder of the narrow path that central banks are treading in their quest for policy normalisation, in a generally challenging policy environment.

- Financial conditions became somewhat tighter in the United States.

And there is plenty more along the same lines, here (and links from there to much more).