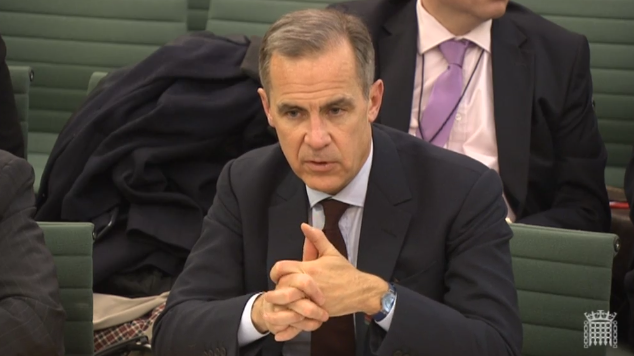

Carney and co. did well to avoid any stirring remarks on Brexit or monetary policy earlier today at the inflation report hearing today

- BOE's Carney: Central bank forecasts assume a smooth Brexit transition

- BOE's Saunders: Likely Q4 economic growth will slow following strong Q3 gain

- BOE's Haldane: Brexit uncertainty could make for a weaker Q4

- BOE's Carney: Implied volatility in sterling is very high

- BOE's Carney: No-deal Brexit would be a very unusual situation

With a Brexit deal not a given just yet, the BOE can't safely assume that they can proceed with any rate hikes for the time being. And Carney has been making that clear over the past two months and he did so again today.

When asked about a no-deal Brexit resulting in a rate hike or rate cut, he gave the safe answer: It depends.

That basically sums up where the BOE stands right now. They can't move forward or give any confident forward guidance to markets until the Brexit mess is sorted out. And that's not likely to happen any time soon. Even if a deal is worked out, the central bank would still need to adopt a wait-and-see approach to ensure that it doesn't overstep by moving too quickly before another Brexit bombshell hits markets.

If you're going to count on sterling traders looking to factor in the BOE - and economic data for the most part - into valuing the currency, that's not likely to happen as long as Brexit uncertainty continues to be the dominant factor in keeping markets, and the BOE themselves, preoccupied.