Bank of America's global research team says via a research note

They argue that this week's dollar strength "may be a harbinger of things to come" - adding that the market may be wrongly positioned for further dollar losses or in their words, "too aggressive in anticipating" that global central banks will catch up to the Federal Reserve in tightening monetary policy.

Their reference is the CFTC report, which shows that investors are still short the dollar more than the average over the past year.

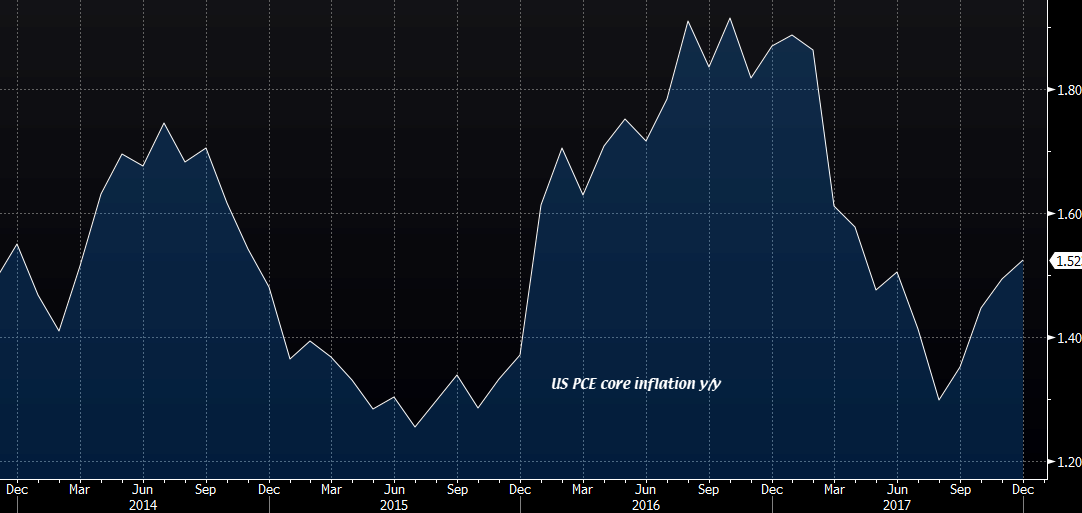

"The market could be wrong by pricing monetary policy convergence too early", the note argues. Further saying that "inflation in the US will increase this year, most likely above what markets expect, and that will be positive for the USD".

They add that investors betting on the ECB and BOJ to shift policies will be disappointed by the scale and the speed of such changes, while arguing that if anything, it's more likely that the policies will diverge further from the Fed.

A different take of things compared to most views that see the dollar to continue to weaken further this year. But so far this week, it's a good return to form for the greenback.