US 10-year yields up 6.4 bps

The US 10-year yield is at its highest levels since March. The break above 2.50% took out a series of resistance levels, including a long-term downtrend that dates back to the 1980s.

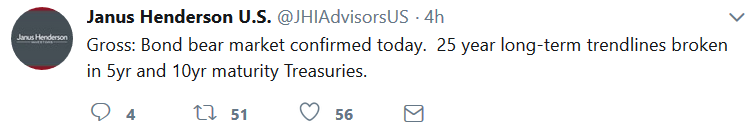

It's something Janus' Bill Gross has been watching for awhile.

The trendline looks something like this in 10s.

Even a small reversion would take the 10-year back to 5% but that would entail something like a return to 4-5% nominal growth and 3% inflation.

Why not?

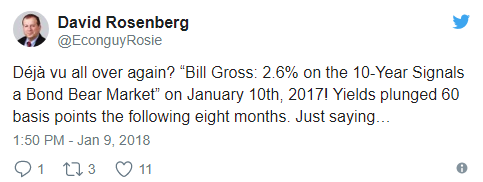

David Rosenberg just joined twitter today and has already figured out that it's a troll-hub.