What's next for copper

There are some very compelling arguments that a significant deficit in copper production is looming.

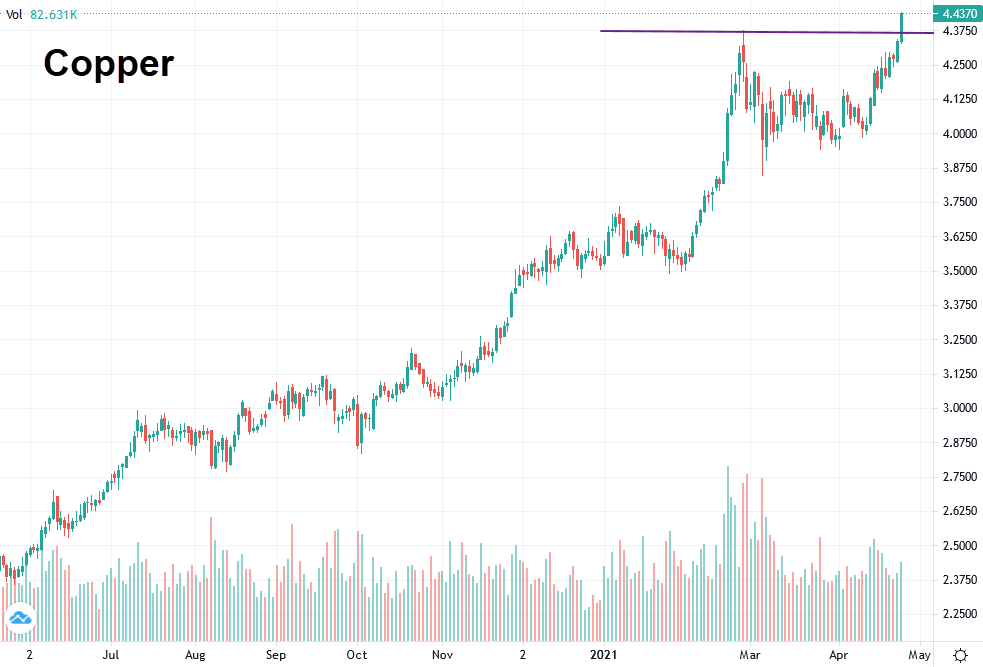

Today's price action certainly underscores that. It's up 10 cents to $4.43/lb, the highest since 2011.

All the infrastructure spending, combined with short-term mine closures at the height of the pandemic, have created a boom. With that, copper will quickly threaten the 2010 high of $4.65.

If that gives way, the sky is the limit. It's tough to envision a scenario where near-term demand drops (even at record high costs) because overall copper costs in most products and projects are still a small fraction of overall costs.

On the supply side, the pipeline for copper projects isn't going to catch up for awhile in part because there's a long lag between sanctioning and production.

For broader market watchers, the signal from Dr Copper is very bullish at the moment and I believe that's the right take.

If you're more interested in a deeper look at copper and refining, here's a extensive thread that shows that refiners are buying unrefined product above the cost of production. The takeaway is that they must believe prices are heading higher and are struggling to meet demand.

Forex Trading