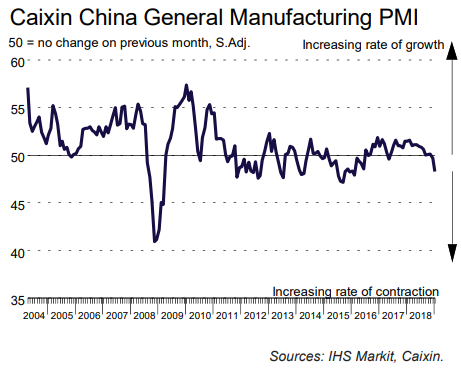

This is the private survey PMI, which tends to include a great representation of smaller firms than the official PMI survey does

Huge drop, down to 48.3. This is the lowest in nearly three years.

- expected 49.6, prior 49.7

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group:

- "The Caixin China General Manufacturing PMI fell further to 48.3 in January, the lowest since February 2016.

- "The subindex for new orders dipped further into contractionary territory, pointing to a moderate contraction in demand across the manufacturing sector. Yet the gauge for new export orders rose notably above the 50 level, the dividing line that separates contraction from expansion, reaching its highest point since March 2018, showing that companies' export orders have obviously rebounded since the truce in the China-U.S. trade war.

- "The output subindex dropped, highlighting the drag effect of softer demand on production. The employment subindex continued to rise moderately despite staying in negative territory, which could be due to the effect of government policies to stabilize the job market. The measure for stocks of finished goods fell into contractionary territory, while the subindex for stocks of purchased items dropped further, suggesting that manufacturers tended to reduce their inventories. The subindex for suppliers' delivery times returned to negative territory, indicating that pressure on capital turnover, though less than in the months before December, still existed.

- "Both gauges for input costs and output charges dropped only slightly. While companies have reduced their inventories, prices of domestic industrial products have since the start of the month recovered some of the losses seen in December. We expect that year-on-year growth in the producer price index is likely to slide closer to zero.

- "On the whole, countercyclical economic policy hasn't had a significant effect. While domestic manufacturing demand shrank, external demand turned positive and became a bright spot amid positive progress in Sino-U.S. trade talks. As companies were more willing to reduce their inventories, their output declined, indicating notable downward pressure on China's economy. China is likely to launch more fiscal and monetary measures and speed up their implementation. Yet the stance of stabilizing leverage and strict regulation hasn't changed, which means the weakening trend of China's economy will continue."

AUD had dropped well prior to the data release …

Leaky? You bet.

--

The official PMIs came out yesterday: