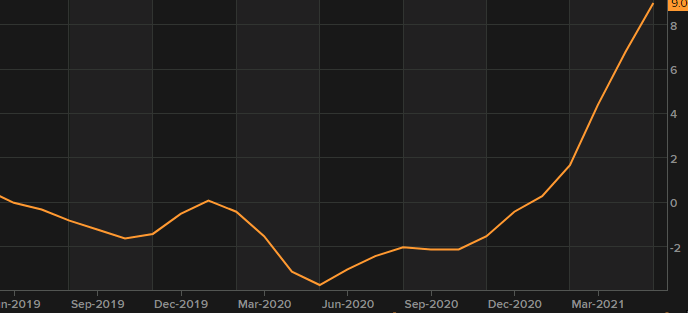

The PPI in China has been skyrocketing, and another jump is expected to be reflected in the data for June due today.

Due at 0130 GMT

China CPI expected 1.3% y/y, prior 1.3%

China CPI expected 0.0% m/m, prior -0.2%

PPI expected 8.8% y/y, prior 9.0%

Consumer-level inflation is mild but the upstream prices are being pressured higher by commodity prices and, less of concern, base effects from comparison with 2020. Softer spending by consumers is keeping these upstream price effects from flowing into CPI. For now.

Meanwhile, the PBOC focus is, apparently, on providing more stimulus to the real economy and slowing a rising yuan:

- More on China's Cabinet talking about RRR cuts - Chinese bond yields sliding

- PBOC yuan intervention, US$23bn amount

- More on potential China RRR cut - in September says the Securites Journal

- China's State Council promises increased support for the real economy, potential RRR cuts

- China says that timely use of RRR cuts will support real economy

PPI, y/y