A note by one of the bank's analyst, Mikael Olai Milhoj, in reaction to the UK inflation report earlier

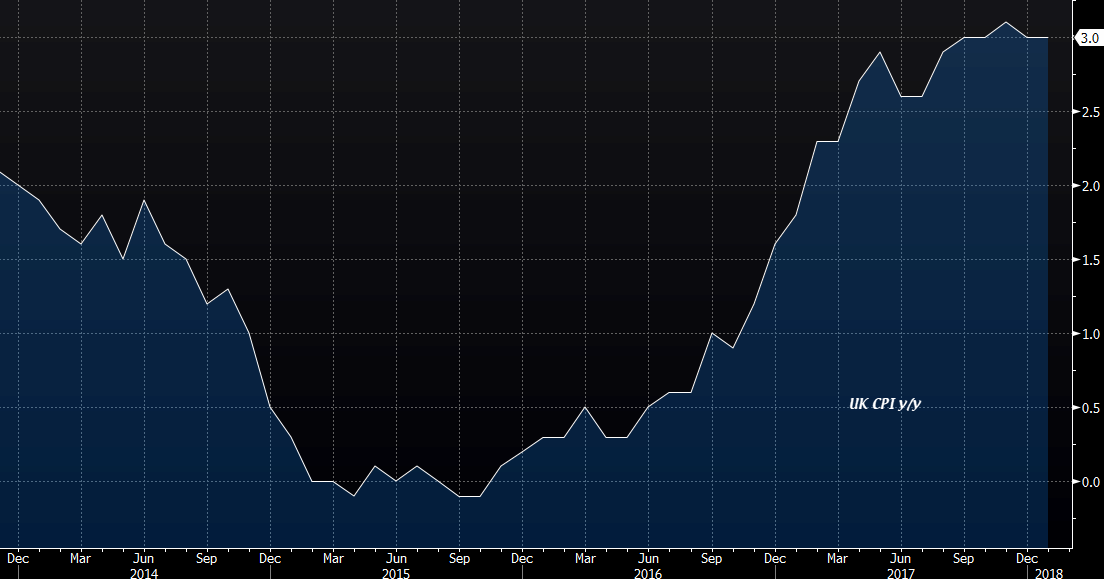

Says that they remain cautiously bullish on sterling, as the prospects of a BOE rate hike in May were supported after CPI y/y held at 3% in January.

"Higher-than-expected inflation supports our view that the BOE may hike already in May, given their concerns about inflation", the note says.

It goes on to say that they remain bullish on sterling but still thinks the biggest increase versus the euro will only be in 6-12 months' time "when we hopefully know more about Brexit and get some clarifications". Milhoj adds that there is a slight risk of EUR/GBP upside due to Brexit uncertainty in the near-term.

Danske's forecast for EUR/GBP is at 0.86 in six months and 0.84 in twelve months.

--

Savage crash - RIP Cryptocurrencies? Five insights from the ASAC Fund.