Via Bloomberg

I was glad I pulled myself out of bed to get the RBNZ rate decision on Wednesday am. There is nothing like a surprise rate cut for a high conviction leveraged trade. However, the move from the RBNZ is just a confirmation of what we have been seeing: increasingly dovish central banks. At the present time it is very difficult to see that outlook changing save a change of relations between the US and China.

Governor Orr was very bearish with his language. He didn't rule out the RBNZ needing to take further action. Negative rates are options and even non-conventional policy (QE). So, the challenge is low global interest rates.

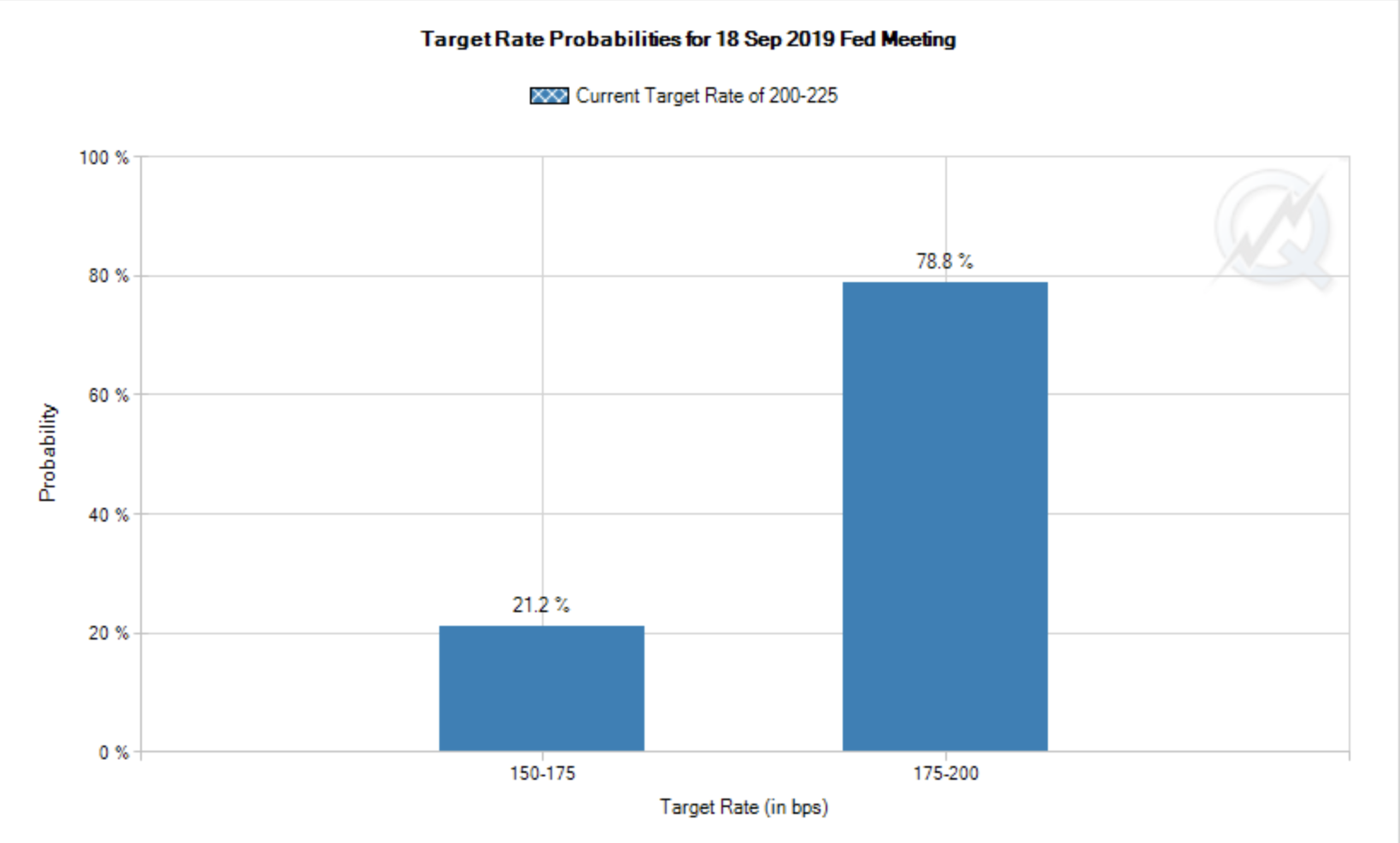

Looking forward the Fed has started easing and there is currently a +20% chance of a 50bps cut at the September 18 meeting, see below.

The ECB are expected to cut rates and the odds of a BoE rate cut are now increasing too. So, buying the dips in developed-rate STIR strips has worked well up to now and looks set to continue in an increasingly dovish world.