UK CPI figures for February being the main highlight of the morning

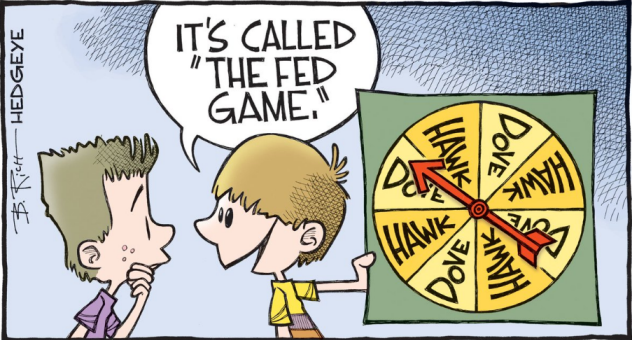

Good day, everyone! Hope you're all doing well as we prepare for the start of European trading today. The dollar is recovering some poise after a softer performance overnight but I would expect markets to be contained ahead of the FOMC meeting decision later today.

Looking ahead, we have UK CPI data to be released but don't expect that to be a game changer as Brexit remains the key driver for the pound at the moment.

0700 GMT - Germany February PPI figures

Prior release can be found here. A lagging indicator of inflationary pressures in the German economy. Low-tier data.

0930 GMT - UK February CPI figures

Prior release can be found here. Just be wary of a potential early release again, like what we saw with the labour market report yesterday. Headline and core inflation are expected to hold steady but regardless, the data here won't do much to add/subtract from pound sentiment as Brexit talks remain the key driver of the currency for the time being.

1100 GMT - US MBA mortgage applications w.e. 15 March

Weekly US housing data, measures the change in number of applications for mortgages backed by the MBA during the week. Not the biggest of data points, but a general indicator of the housing sector sentiment.

1100 GMT - UK March CBI trends total orders, selling prices

Prior release can be found here. Readings above 0 indicates optimism while below indicates pessimism. The headline is a survey on manufacturers to rate the level of volume for orders expected during the next 3 months. A minor data point.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading!