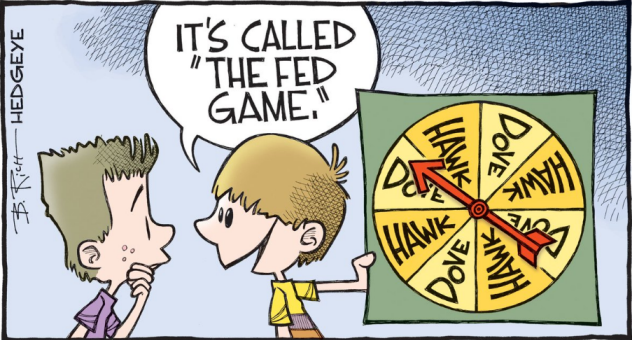

Fed giveth, Fed taketh away

Happy Friday, everyone! Hope you're all doing well as we look to get things going in the session ahead. It has been an eventful past two sessions in markets as the dollar was brought down on dovish comments by Fed members only for the New York branch to clarify that comments by John Williams were merely "academic".

That saw the greenback rebound in early Asia Pacific trading and will be the key focus ahead of European trading today, despite gains leveling off a little to start the morning.

Economic data releases will be thin once again but pay attention to the final round of Fed speakers before the blackout period begins ahead of the FOMC meeting.

0600 GMT - Germany June PPI figures

Prior release can be found here. A proxy indication of inflationary pressures. Not a data point that matters all too much as this lags the CPI data release.

0800 GMT - Eurozone May current account balance

Prior release can be found here. General indication of flows in/out of the Eurozone economy. A minor data point considering the current market environment.

0830 GMT - UK June public sector borrowing data

Prior release can be found here. A look at the UK budget deficit and general gauge of fiscal health. Not one to really impact markets at this point in time.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading!