A light calendar day as market focus turns towards the Fed

Good day, everyone! Hope you're all doing well as we look to get things going in the session ahead. It's been a slower start to the day with the aussie and kiwi the notable laggards but nothing too alarming as we look towards European trading.

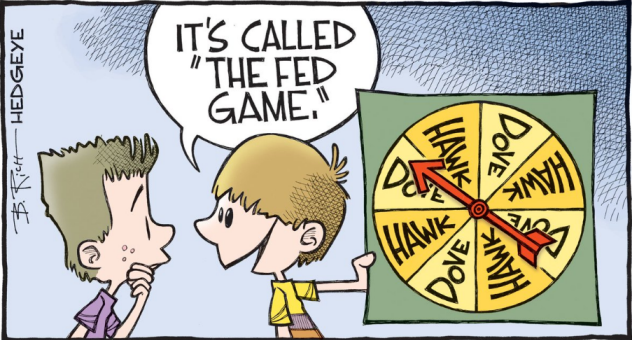

The uncertainty surrounding the repo market has left the dollar in a bit of a softer position in the run-up to the Fed later today and essentially the Fed having to inject cash into the money market proved they themselves don't know what is happening.

The real worry here is that this won't just be some short-term anomaly and the Fed having to constantly step in or introduce more permanent measures to address the issue is a sign of an unhealthy market.

There is zero chance the Fed can afford to lose control of rates (especially the EFF), so we could possibly see them put up a standing repo facility (while trying to dig deeper to figure out the root of the problem) or reintroduce QE of sorts by bolstering the balance sheet.

Whatever the case is, there is potentially something roil in the money market and repos that are undermining the Fed's capacity to fully transmit monetary policy to the real economy. That is not a good signal to businesses and consumers if this persists.

Looking ahead, markets are likely to keep the calm ahead of the FOMC meeting decision with traders surely keeping an eye on how the Fed and Powell will address the issue above.

0830 GMT - UK August CPI figures

0830 GMT - UK August PPI figures

Prior release can be found here. Inflationary pressures are expected to soften a little but maintain a rather solid showing overall. That said, the data here will do little to shift any expectations on the BOE bias/outlook as Brexit remains the main focal point. Expect the market reaction - if any at all - to the data here to be short-lived.

0900 GMT - Eurozone August final CPI figures

The preliminary report can be found here. As this is the final release, it isn't expected to produce much - if any - reaction in markets.

0900 GMT - Eurozone July construction output data

Prior release can be found here. An indication of construction activity in the euro area economy, not a major release by any means.

1100 GMT - US MBA mortgage applications we. 13 September

Weekly US housing data, measures the change in number of applications for mortgages backed by the MBA during the week. Not the biggest of data points, but a general indicator of the housing sector sentiment.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading!