German and Spanish inflation data in focus today

The dollar and yen gave up some ground in trading yesterday and though more narrow ranges are prevailing for now, the slightly more positive risk tilt is once again leading the market to err a little more in a similar direction to start the day.

The pound is continuing to build on the optimism from yesterday as cable trades higher to 1.2860, though still off yesterday's high of 1.2930.

Meanwhile, EUR/USD is meeting some near-term resistance around 1.1680 but buyers have managed to push above the 100-hour moving average for now.

The 1.1700 handle remains the key spot to watch and will be a vital pivot point in terms of dollar sentiment, should we run into a test of the level later on.

Elsewhere, US futures are also up by ~0.2% though the optimism in Asia is more measured for the time being.

All eyes will be on the risk mood and the dollar once again, but the euro will have to navigate through inflation data over the next few days. As for the pound, Brexit risks remain the key factor to watch in trading this week.

0645 GMT - France September consumer confidence

Prior release can be found here. An indication of consumer morale in the French economy, a relatively minor data point.

0700 GMT - Spain September preliminary CPI figures

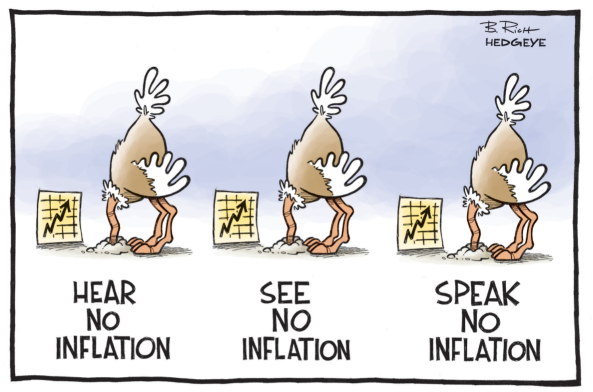

Prior release can be found here. The data here may not have much immediate impact but it feeds into the narrative of softer inflation pressures in the euro area, which factors into the gradually increasing urgency of the ECB maybe needing to step up with more measures to guide inflation back on the right path.

0830 GMT - UK August mortgage approvals, credit data

Prior release can be found here. Despite some positive points in the UK recovery over the past few months, consumer credit has largely struggled and that points to some fragility in how sustainable the recovery can be held up - especially the long-term.

0900 GMT - Eurozone September final consumer confidence

0900 GMT - Eurozone September economic, industrial, services confidence

Prior release can be found here. A general read of economic sentiment in the Eurozone, not the biggest of data points by any means.

1200 GMT - Germany September preliminary CPI figures

Prior release can be found here. Expectation is for German inflation to stay more subdued this month and that will just maintain the narrative of softer inflation pressures across the region. That means the ECB will have to monitor developments more closely to prevent any de-anchoring of inflation expectations moving forward. The state readings during the day will offer more of what to expect in the run up to the national reading.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.