A light data docket on the calendar once again

It was a bit of a turnaround Tuesday as the dollar fell considerably, equities crept higher and Treasury yields eased following the strong auction yesterday.

The dollar decline led to some notable price action in dollar pairs, with EUR/USD now testing its 100-hour moving average just above 1.2200. Meanwhile, AUD/USD has moved back above both its key hourly moving averages (0.7735-41) as buyers seize control.

Elsewhere, USD/JPY fell back below 104.00 and below its 100-hour moving average after the key trendline resistance levels held up above the figure level.

In the commodities space, gold and silver both posted gains following four consecutive days of declines; keeping a defense of key levels with gold above its 200-day moving average and silver above its own 100-day moving average.

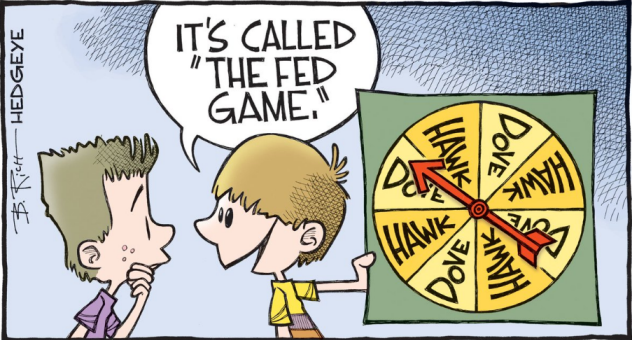

A developing theme in the market is the Fed as it seems that talk of prolonged easing is being called into question and 'tapering' is starting to come into the picture. I'd argue that it is still premature but you have to read what the market is saying as well.

All of that will still be subject to US data and virus conditions, so we'll have to see how that plays out in the coming months. I mean, it's only January now.

0700 GMT - Germany December wholesale price index

The index measures the value of sales made by wholesalers in Germany, it provides an indicator of consumption and retail pattern. A minor data point.

1000 GMT - Eurozone November industrial production data

Prior release can be found here. Factory output is expected to improve slightly in the euro area in November, largely led by Germany. However, the data here is a lagging one and doesn't offer much to prevailing market sentiment.

1200 GMT - US MBA mortgage applications w.e. 8 January

Weekly US housing data, measures the change in number of applications for mortgages backed by the MBA during the week. The focus will once again be on purchases as that has been one of the more bullish spots outlining that US economic conditions are not as dire as first suggested by the recent dip due to the coronavirus impact.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.