A couple of light data points to move things along as we count down to the first FOMC meeting of the new year

The dollar was slightly pressured yesterday while US equities were more tepid after the rebound in futures from early losses seen in European trading. That is leaving little for the market to work with in general to start the new week so far.

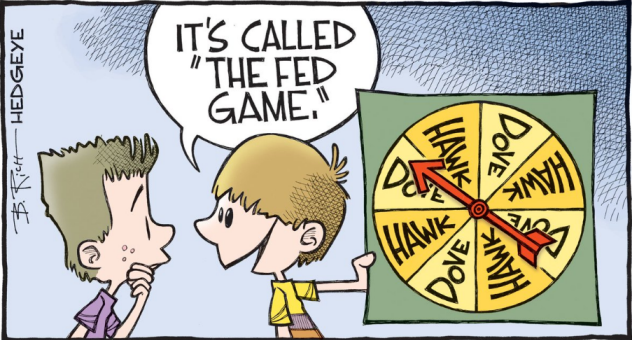

All eyes remain on the Fed and while we may expect Powell & co. to reaffirm what we already know, it may serve as a timely reminder for the market as the reflation narrative settles down and takes a breather for now at least.

Major currencies are mostly little changed, with commodity currencies keeping a little lower but nothing extensive after having posted modest gains yesterday.

EUR/USD is holding jut above its 100-hour moving average for now as buyers keep near-term control and GBP/USD is keeping a break above the 1.3700 handle from yesterday.

Elsewhere, gold and silver continue to look more tepid as well with the former still holding around its 200-day moving average and look to take more clues from the Fed later.

Looking ahead, there won't be much in Europe to shake things up but the dollar and risk mood will continue to be key drivers to watch before we get to the Fed at 1900 GMT.

0700 GMT - Germany February GfK consumer confidence

Prior release can be found here. German consumer morale is expected to keep more subdued as the virus situation continues to call for tighter measures to be maintained, with some consideration that it might lead to a travel halt as well.

0745 GMT - France January consumer confidence

Prior release can be found here. French consumer morale is estimated to keep at about similar levels to December as the virus situation continues to stretch medical capacity across the country but any major lockdown is still not in the works just yet.

0900 GMT - Switzerland January Credit Suisse investor sentiment

Prior release can be found here. The reading measures analysts' expectations on the Swiss economy and other economic expectations over the next 6 months. A minor data point.

1200 GMT - US MBA mortgage applications w.e. 22 January

Weekly US housing data, measures the change in number of applications for mortgages backed by the MBA during the week. The focus will once again be on purchases as that has been one of the more bullish spots outlining that US economic conditions are not as dire as first suggested by the recent dip due to the coronavirus impact.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.