A rather empty calendar day as the focus shifts towards the Fed

Evergrande worries are still at play but we may see the market put a pin on that as the focus and attention today shifts towards the FOMC meeting later.

There is a perceived calm in the market right now but I'd argue that says a lot more about the indecision and nervousness among investors rather than keeping a steady hand.

Looking ahead to Europe, there isn't anything on the agenda to shake things up so all eyes will turn towards the Fed for any further clues on trading sentiment today.

In that lieu, there's only one key thing to watch out for - that being 'tapering'.

If the Fed is to actually taper by year-end, this is the meeting to tee up expectations of that considering that there are only three more FOMC meetings left (this included).

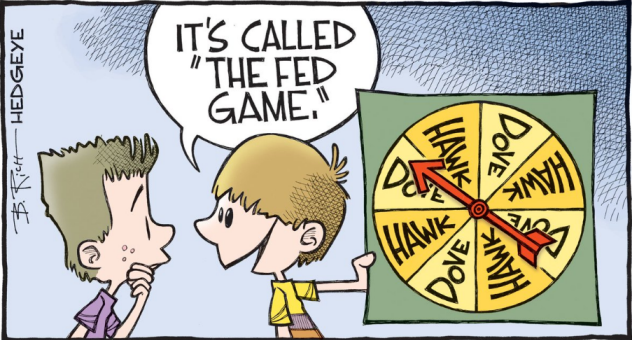

The market isn't expecting an imminent taper announcement and if that comes, it will lean towards being more hawkish than expected. It would also be a major surprise as Powell has reiterated that they would have given some warning well beforehand.

As such, the expectation is that they will at least acknowledge taper discussions have started and that there is the possibility of laying out the groundwork to taper before year-end. Perhaps Powell may steer clear of the timeline but it will be implicit.

One key spot to watch will be changes to the statement and the progress that the economy is making. The issue with the Fed is that they don't really have differing metrics in starting tapering and gearing towards liftoff in rates.

As such, the market may still run with a kneejerk reaction higher in the dollar and yields if we do see such hawkish changes to the Fed statement today.

Otherwise, expect any major taper signals to come via Powell's press conference instead, if the Fed is smart enough to play things safe and make a clear distinction that tapering does not necessarily mean that the central bank is close to raising rates.

1100 GMT - US MBA mortgage applications w.e. 17 September

Weekly US housing data, measures the change in number of applications for mortgages backed by the MBA during the week.

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.