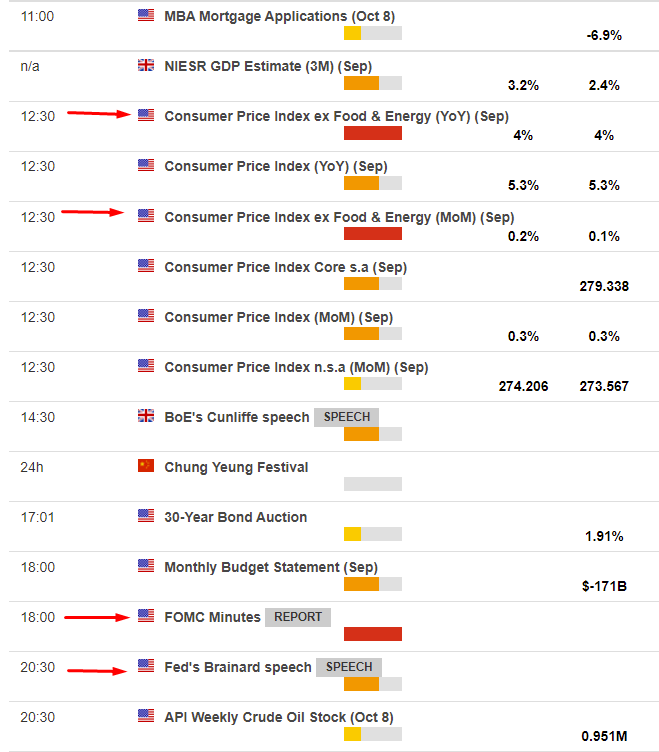

Posting what is due on the data docket as a screenshot from the ForexLive calendar, you can access it here for more.

- The times on the left-most column are GMT.

- The numbers in the right-most column are the 'prior' (previous month) result. The number in the column next to that, where is a number, is what is the consensus mdeian expected.

- The red arrows are my highlighting the important things to watch for.

- Also, for more on Fed speakers coming up: Federal Reserve speakers coming up on Wednesday 13 October 2021 (FOMC minutes too)

There is a skewed upside risk to the CPI numbers due to the continuing rises in both new and used vehicle prices & shelter costs. In their preview, Scoita highlight vehicles specifically:

- when combined, used and new vehicle prices should add 0.2-0.3% m/m to headline CPI before we even turn toward other considerations. Then leverage that up for core CPI that is about 79% of total CPI to get a total vehicles contribution to core CPI inflation of about 0.3-0.4% m/m. If this tracking of vehicle prices translates well into CPI, then it's also likely that the related category of vehicle insurance premiums won't repeat as one of the top three downsides to US CPI during August