Light calendar greets US traders

Last week ended with a bang on the release of retail sales and CPI. This week is more subdued as the Fed enters its communication blackout and the economic data calendar ebbs.

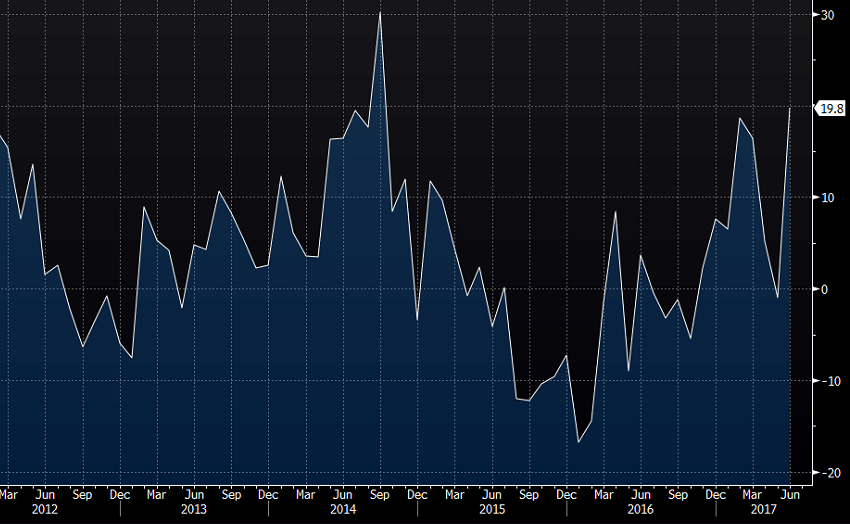

The main release today is due at the bottom of the hour with the Empire Fed. It measures manufacturing sentiment in the area around New York. The consensus is for a 15.0 reading compared to 19.8 prior.

The index has been choppy lately but touched the highest since 2014 in June.

I don't expect it to be much of a market mover but a weak number could tilt the dollar sellers again. Keep an especially close eye on AUD/USD as it approaches Friday's high and some major long-term levels.