Major indices recovered from sharp declines earlier in the day

European major indices are ending the session with mostly gains. Spain's Ibex is the exception. Most of the indices are well off of their earlier lows:

The provisional closes are showing:

- German DAX, +1.6%. The low reached -1.86%

- France's CAC, +0.5%. The low reached -3.1%

- UK's FTSE 100, +0.9%. The low reached -2.88%

- Spain's Ibex, -1.15%. The low reached -3.9%

- Italy's FTSE MIB, +0.7%. The low reached -3.0%

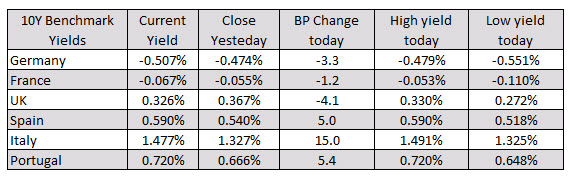

in the European debt market, the benchmark 10 year yields are mixed with Germany, France and UK yields lower while Spain, Italy, Portugal yields moving higher:

A snapshot of other markets as London/European look to exit shows:

- Spot gold down $8.20 or -0.51% at $1619.92

- WTI crude oil futures are down $1.14 or -5.3% at $20.36. The low price today did move below the $20 level and $19.85.

In the US stock market the major indices are trading solidly in the black:

- S&P index +2.23% at 2597.74

- NASDAQ index +2.61% at 7698.77

- Dow +2.01% at 22073

In the US debt market, yields are mixed with the yield curve flatter. The 2 year is up 1.2 basis points. The 10 year is down -3.2 basis points. The 2-10 year spread is 38.95 basis points down from 43.28 basis points at the close on Friday:

In the forex, the USD remains the strongest currency while the CAD remains the weakest. Since the NY open, the CAD has actually strengthened a little. The USD has gotten a bit stronger.