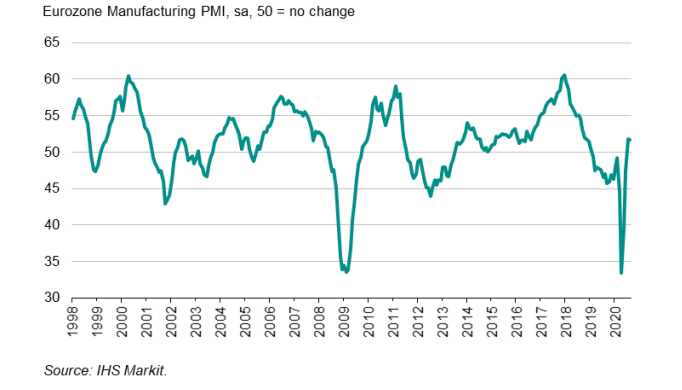

Latest data released by Markit - 1 September 2020

The preliminary release can be found here. This just confirms that factory activity held up somewhat in August across the euro area, keeping on the recovery path.

However, there are ongoing concerns surrounding domestic demand conditions and amid the hit to the services sector last month, it continues to allude to a considerable degree of uncertainty involving the virus situation in general.

We'll have to see how things go in the coming months for a better idea on how the recovery is progressing within the region. Markit notes that:

"Eurozone factory output rose strongly again in August, providing further encouraging evidence that production will rebound sharply in the third quarter after the collapse seen at the height of the COVID19 pandemic in the second quarter. Business expectations for output in a year's time also rose to the highest for over two years as prospects continued to brighten from the unprecedented gloom seen earlier in 2020.

"Caution is warranted in assessing the likely production trend, however, as so far it would have been surprising to have seen anything other than a rebound in output and sentiment. Worryingly, order book growth cooled slightly in August, and there are indications that firms are bracing for a near-term weakening of demand.

"Of note, a key theme of the latest survey is one of firms taking a cautious approach to costs and spending, notably in respect to investment and hiring, amid continued worries about the strength of future demand and uncertainty over the course of the pandemic. Producers of investment goods such as plant and machinery reported the weakest order book growth, and job losses remained amongst the most prevalent since the global financial crisis.

"Whilst the drop in payroll numbers was led by Germany, France, Spain and Austria reported a reacceleration of job losses and a return to job cutting was seen in Ireland, sending worrying signals that many firms have become more concerned about the near-term outlook.

"In short, manufacturing is currently being buoyed by a wave of pent up demand, but capacity is being scaled back. The next few months' data will be allimportant in assessing the sustainability of the upturn."