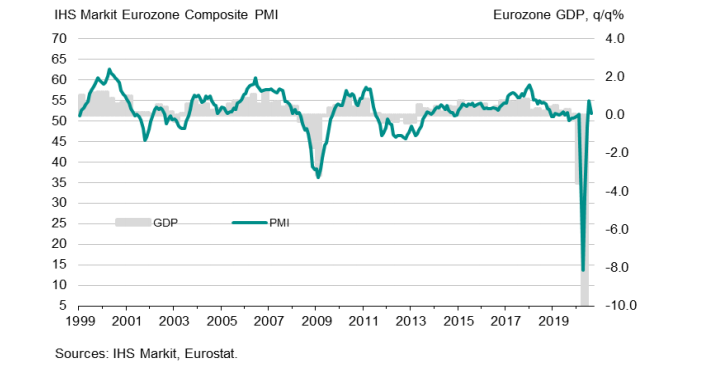

Latest data released by Markit - 3 September 2020

- Composite PMI 51.9 vs 51.6 prelim

The preliminary report can be found here. Some slightly higher revisions but the story is the same as per what we are seeing across all the other national readings today i.e. a loss in momentum in the recovery.

The narrative is that the economic recovery in the region owes much to domestic demand, but that can only do so much as new business is somewhat lacking.

Add that on top of the more subdued labour market conditions, it is keeping the pace of the recovery limited and it remains to be seen how the situation will fare as we look towards the latter stages of the year. Markit notes that:

"Service sector companies across the eurozone saw growth of business activity grind almost to a halt in August, fueling worries that the post-lockdown rebound has started to fade amid ongoing social distancing restrictions linked to COVID-19.

"The near-stalling needs to be viewed in the context of the strong expansion seen in July: business growth had surged to a near two-year high as economies opened up further from the severe COVID-19 lockdowns. However, the latest reading still sends a disappointing signal that the rebound has lost almost all momentum.

"The deterioration was often linked to worries of resurgent COVID-19 infection rates, notably among consumer-facing companies and especially in Spain and Italy, where virus containment measures remained particularly strict.

"The larger size of the services economy means the subdued picture offsets the more upbeat survey of manufacturers in August, suggesting that the overall pace of economic growth has waned midway through the third quarter.

"Although the relative strength of the PMI data in July and August mean the autumn is likely to still see the economy rebound strongly from the collapse witnessed in the spring, the survey highlights how policymakers will need to remain focused firmly on sustaining the recovery as we head further into the year."