From HSBC … let’s start with these:

(Note from 8 Sep.)

More (bolding mine):

- We expect further EUR downside in the short-term as the divergence in economic and policy outlooks is set to remain abundantly apparent over the coming weeks

- The announcement effect of the surprise interest rate cut and the planned nonconventional easing has already provoked a sizeable knee-jerk drop in the EUR. But we believe the adjustment has further to run, especially into the Fed meeting and alongside stronger US data

- One aspect of this easing that FX will be mindful of is that the ECB has become clearer that they view a lower currency as an important part of the solution. The ECB’s Nowotny said the latest interest rate cut “was mainly meant to lead to a reversal of the euro appreciation. The key was the influence on the exchange rate”.

- The ECB has moved from not talking about FX, to claiming the exchange rate was just part of the inflation outlook, to accepting that it has become a policy target.

- If you want to buy the EUR, it now means betting against the ECB. Rhetoric and action from the central bank will have one eye constantly on the exchange rate.

And:

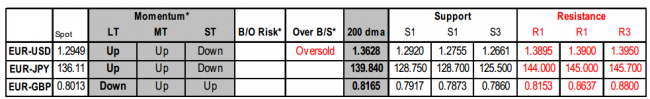

- IMM data points to a clearly stretched position in the EUR, and our technical analysis points to an oversold position in EUR-USD

- But it is not clear where the trigger for a lasting squeeze will come from

- The reaction in EUR-USD, for example, to the softer than expected US employment report was a relatively feeble squeeze higher. If the pull-backs are not painful, an extension lower is likely

- Unless things are tripped up by the Fed or US data, we would expect to see EUR-USD head lower to 1.2800 and perhaps even challenge last year’s lows around 1.2750.

–

Some good items in there to add to your list.