Yes indeed, the focus is on the USD and tonight's inflation report ... but if you'd like a head start on Thursday

- Australian January employment data due at 0030 GMT Thursday 15 February 2018

Preview via ANZ:

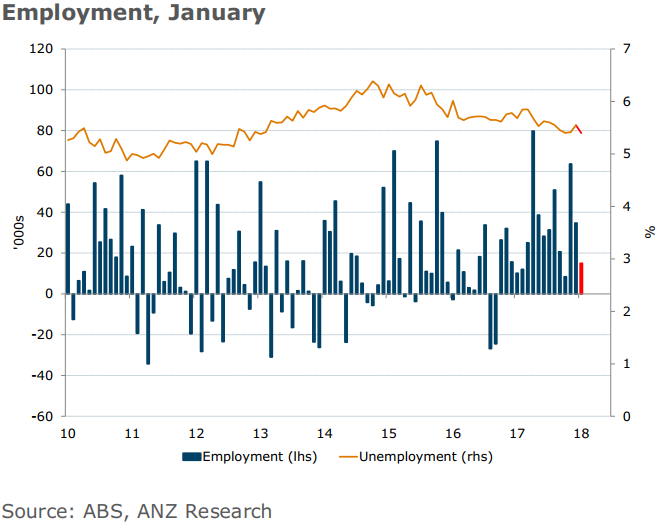

- After another sterling jobs gain in December, we are looking for a more moderate rise in employment in January.

- While the fundamentals remain strong, the recent large gains have left official jobs growth running ahead of leading indicators.

- We look for a rise of 15K and a tick back down in the unemployment rate to 5.4%

----

National Australia Bank:

Thursday's labour force data will be closely watched, as markets look for any sign that the stellar job growth over 2017 will start translating into a lower unemployment rate.

The print is particularly important following RBA Governor Phil Lowe's speech, which emphasised the importance of the labour market to the RBA's view of the economy.

- Dr Lowe called out wage growth as a particular area of attention for the RBA, while stating that the Bank needs to see further clear improvements in unemployment and a rise in inflation before raising rates.

A similar message was carried in the release of the Statement of Monetary Policy (SoMP), where the RBA is conveying optimism about the direction of the economy, the labour market and inflation.

- The RBA is predicting the unemployment rate to decline to 5¼% by mid-2018. While this is a touch lower than the previous SoMP, this change reflects a slight shift in response to a lower-than expected December unemployment print.

For this month's jobs print, NAB is expecting another strong month of jobs growth. Our models and evidence point to +35k jobs growth, which could also be helped by ABS sample rotation effects.

- On the unemployment rate, we expect a modest decline to 5.4%, with a flat participation remains at 65.7%.

- Currently, the participation rate is just shy of its record high during the mining boom (65.8%), although the composition of the economy is very different.

- Our analysis shows that the participation rate could go higher, given the solid growth in female participation (that is potentially NDIS-related).

---

Long live cryptocurrencies? Five insights from the ASAC Fund