When the going gets tough, the tough do these five things

Tip#1 Deleverage

The use of leverage is arguably the most important aspect of risk management and proper risk management should be the top priority of all traders. If you are struggling and losing money in the FX market at the moment then the first step is to deleverage. If you want to do some further reading on the impact of leverage on risk management have a read here of an article I wrote in February this year.The impact of leverage plays havoc with trading psychology and it was the first mistake I wrote about on a series I wrote titled: 5 trading mistakes to avoid. In the first part of that series I wrote:

"The more leverage you use, the harder it is to trade with a clear head. If you use too much leverage you will find it hard to not interfere with your trades. You will make more and more emotional decisions and experience deep, and rapid swings in your equity curve. Are you struggling with your trading at the moment? Then it may be possible that over leveraging is either causing your trading mistakes, or making them worse. Beware the danger of over leveraging. With some brokers offering leverage at levels of 1:50, 1:100 and 1:200+, the temptation to trade with borrowed money is huge. However, that leverage comes at a price and it may be the cost of your trading account if you leave it unchecked. I personally advocate trading without leverage, especially for the newbie trader, and only using a small amount of leverage in specific situations"

Tip#2 Trade in line with sentiment

This is such a key point, that once you have grasped it, you won't easily forget it. Every day Adam, Eamonn, Greg and Justin are continually tuning in and reporting on market sentiment. Think of market sentiment simply as the 'mood of the market'. Say for example, the Reserve Bank of New Zealand decided to unexpectedly cut interest rates at their next rate meeting, then NZD will be sold. The sentiment for the next few sessions would be to sell NZD. Therefore, you would not want to be buying NZD. Here is an example below when I traded the NZD in August as the RBNZ cut rates. It was a simple trade, with little draw down and was in line with sentiment. Weak NZD and stronger JPY on risk off sentiment. Entry and exits at red arrows on chart below.

Tip#3 Don't use ultra tight stops

This is a death by a thousand cuts. If you continually use ultra tight stops, you risk being stopped out prematurely and continually. This slowly drains your account. Assuming that you are trading in line with the sentiment, then your position should be supported. Therefore, if you are trading intraday, anchor your stops above or below previous days highs or lows. Put your stops in the place where you know that 'you are definitely wrong'.

Tip#4 Work on your trading psychology

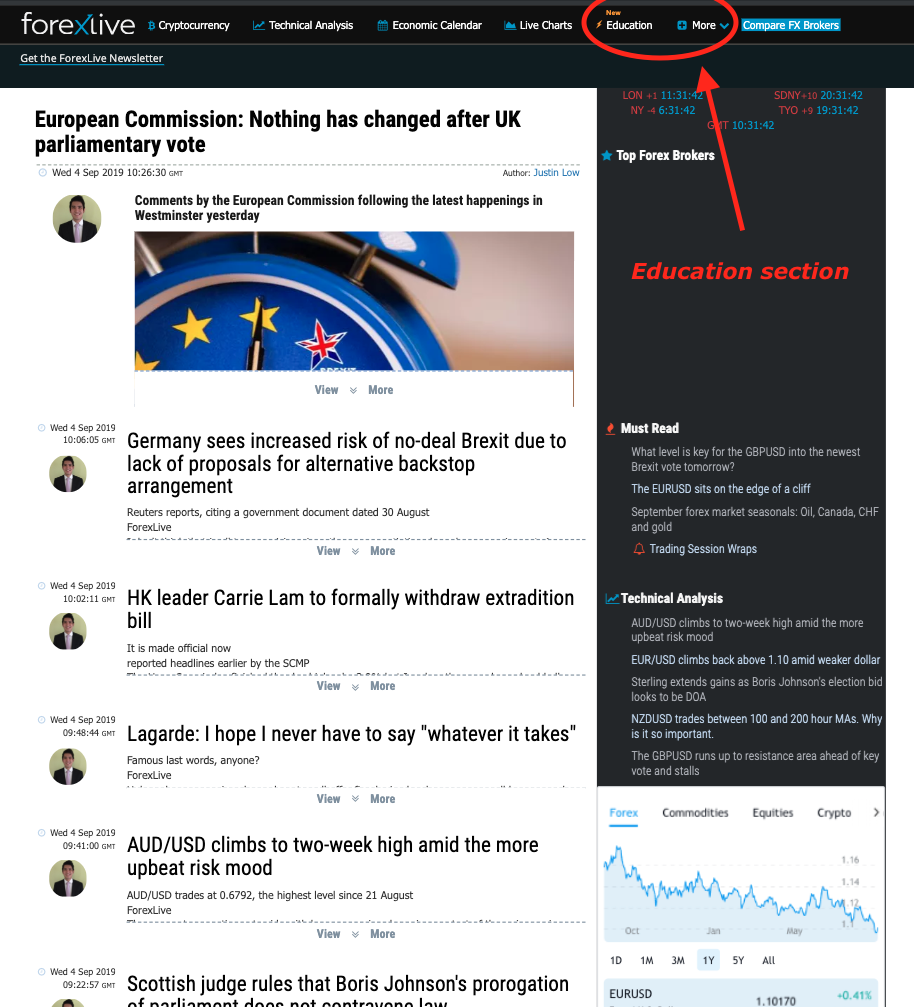

Competence is the father of confidence, granted. However, the psychological nature of trading can often be overlooked and seen as unnecessary. I have written a few different articles on this important subject, so if you have ignored market psychology until now, or would just like a refresher, take a look at the articles below which can be found in our education section.

- How to best view emotions you fell while trading

- Respond, don't react in your trading.

- How to develop a strong trading mindset

- No-one was born to win, it's just a matter of technique

All these articles, and many more, are available ins our education tab. If you haven't had a look yet, spend some time exploring the site as there is a wealth of free material to enjoy.

Tip#5 Trade in line with fresh sentiment

This is a key concept to grasp. Often times the same story is repeated over and over again on the news feeds. The same position is re-iterated ad nauseam. The tricky part here is that you need to think when you hear a news story, 'Is it fresh, is it significant'. I tried to come up with a little acronym to help with this and I failed. The closest I got was this memory aid. NEWS: Is it NEW is it Significant? By asking yourself this question you will help yourself not get sucked into unnecessary trades. Read my article here on the key to trading fresh sentiment and see my heads up I wrote for the NZD business confidence data before it came out as an example of seeing sentiment trades in advance. The key principles in that article revolve around two key concepts:

So, what are the keys to trading fresh sentiment?... the two key concepts to trading fresh sentiment are as follows:

- Picking which sentiment change to focus on and;

- Trading that sentiment while it is still fresh