Forex news for Asia trading Wednesday 12 February 2020

- China hopes countries will lift virus-related travel restrictions ASAP

- Singapore budget due on February 18 - A big package of measures to cushion coronavirus hit expected

- Foxconn hopes to resume 50% of production by end-Feb and 80% in March

- ICYMI - Bankers in Asia brace for a virus-related deal drought

- IMF official - too early to assess coronavirus impact on economies

- China reports 2,015 new coronavirus cases (new reporting guidelines … )

- RBNZ Gov. Orr says assumes coronavirus impact will last 6 weeks

- RBNZ Governor Orr speaking at his post-statement news conference - live link

- Responses to the RBNZ statement - "surprised the market"

- PBOC sets USD/ CNY reference rate for today at 6.9718

- FX option expiries for Wednesday February 12 at the 10am NY cut

- NZD jump on the RBNZ statement - the Bank do not forecast any rate cut this year

- RBNZ leaves cash rate on hold as expected

- Goldman Sachs downgrade to China GDP growth forecast, to 5.2%

- US says China purchases of US Ag products to be impacted by coronavirus

- 39 more people from the Japan cruise ship have tested positive for coronavirus

- Westpac on the RBA - "surprisingly confident forecasts"

- China GDP growth - S&P estimates coronavirus cut 0.7 % from year

- Australia Westpac-MI consumer confidence survey (February): +2.3% m/m (prior -1.8%)

- GBP on its way to 1.35 - data improving and the Boris bounce

- Goldman Sachs says underweight exposure to the CAD, NZD

- New Zealand - Retail Card Spending for January -0.1% m/m (expected 0.4%)

- Trade ideas thread - Wednesday 12 February 2020

- Private-survey oil inventory data shows larger than expected headline build

An upbeat RBNZ flipped away from a dovish stance in their Monetary Policy Statement today. The Bank left the OCR unchanged at 1%, a widely (basically unanimously) expected decision but the big news was a shift to neutral in their outlook for the balance of this year - their projections show no rate hikes for 2020. A more hawkish take is that they project a rate hike as the next move, but that is well into 2021, H2 (see bullets above for more).

The NZ dollar gained around three-quarters of a US cent (at its session high) but has since backed off a little. This dragged AUD along for a few points gained also.

There was little news of impact otherwise. Justin posted yesterday on the change to how China is reporting coronavirus cases

There have been many, many questions about the veracity of the reports up until now, and this will only serve to increase those questions. The data today, for example, showed a continuing stabilisation in new cases. But is this correct? All baises aside the change in definition does muddy the waters a bit.

Apart from the kiwi move (and the echo in AUD) movement across other major FX was limited, small ranges only.

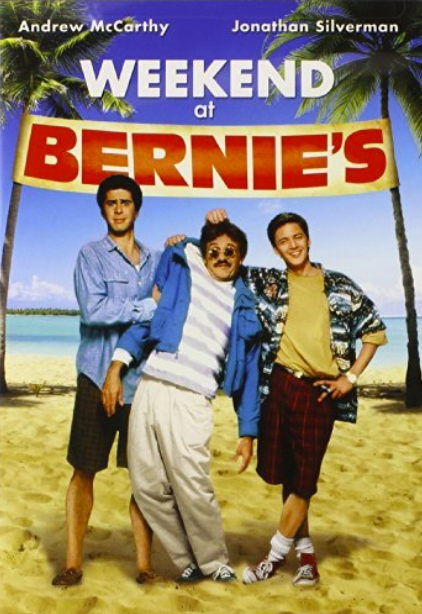

For the US politics folks, Bernie Sanders won the Democratic primary in New Hampshire. Congrats to him. I do wonder if the loss of Jeremy Corbyn in the UK election may have been forgotten already. And what's-his-name in Australia last May too.