Forex news for Asia trading Friday 12 July 2019

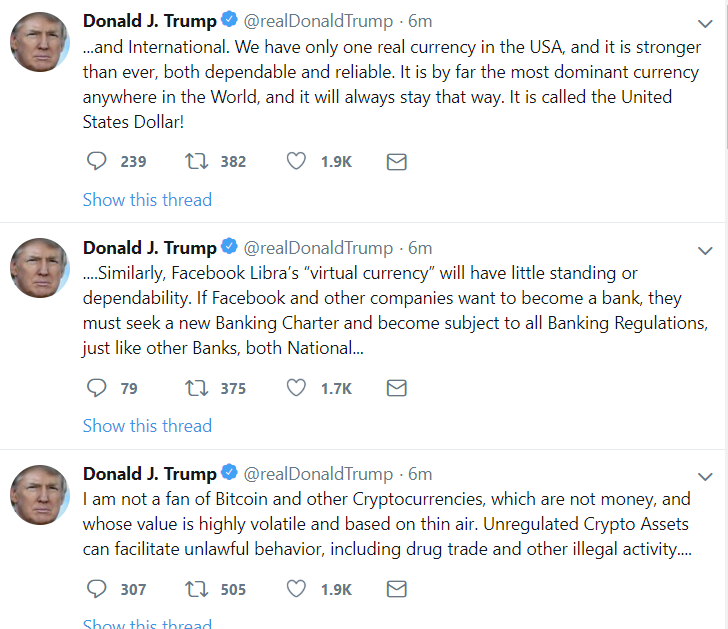

- More on Trump blasting Bitcoin and Facebook's Libra

- China press: "cannot rule out the possibility that China may cut its benchmark interest rate"

- AUD traders - next week has RBA (minutes) and jobs market data

- Singapore slump - Monetary Authority of Singapore to lower SGD before October?

- PBOC sets USD/ CNY reference rate for today at 6.8662 (vs. yesterday at 6.8677)

- Forex options expiring Friday 12 July 2019 at 10am New York cut time

- More on Singapore's Q2 economic growth - its slowest in 10 years

- Trump is a big fan of the USD - "dependable and reliable... the most dominant"

- This is why US President Trump is in a no lose situation in the trade war with China

- Singapore Q2 GDP data is not good: -3.4% q/q (annualised)

- Oil (ICYMI) - OPEC sees new oil surplus in 2020 (cut ze output!)

- Gold - "central bank buying spree"

- New Zealand - BusinessNZ Manufacturing PMI for June: 51.3 (prior 50.2)

- US President Trump accused China of backsliding on promises

- UK airline head warns GBP will collapse to parity with USD if no-deal Brexit - "devastating" to business

- Fed's Brainard says downside risks and soft inflation argue for easing monetary policy

- Fed's Kashkari speaking - economy not at full capacity until wages pick up

- New Zealand data - house prices up, number of sales fall (y/y)

- Trade ideas thread - Friday 12 July 2019

- HK press: US officials push for sanctions on China over oil purchases from Iran

- Goldman Sachs now with a heads up on the rising risk of USD intervention

Trump's anti-cryptocurrency tweets that made some waves:

Trump's tweets come as Fed Chair Powell replied to Congress that he wants to see tighter control on digital products, with JPM and Facebook to launch cryptocurrencies. More in the posts above.

BTC popped against the USD on the Presidential tweets but has subsequently come back to be not too far from where it was prior.

In forex we have seen a net move weaker for the USD against most currencies. The moves have been restained, USD/JPY initially ticked just a little above its US-time high to edge over 108.60 before dropping toward 108.30. Its circa 108.40 as I update.

AUD and CAD have both put on a few points gain against the USD for the session, both surpassing their US time highs and maintaining above.

As I said, news and data flow was light. What we did get is of interest to SGD traders - an terrible collapse for Q2 GDP in Singapore (see bullets above). This is likely to prompt Monetary Authority of Singapore easing at their next meeting (October) but its difficult to rule out the bank going before then (the risk of waiting until October is further weakness for the SG economy).

Stay tuned folks - we have China's trade balance for June due soon, at 0700GMT.