Forex news for Asia trading on Wednesday 12 May 2021

- CBA says Australia is most likely to lose its AAA rating

- Coronavirus- Taiwan to tighten restrictions

- US inflation data due Wednesday 12 May 2021 - preview

- Australian international airline cancel most flights scheduled for October through to late December

- US EPA temporarily suspending clean fuel requirements to ease gasoline shortage

- PBOC sets USD/ CNY mid-point today at 6.4258 (vs. yesterday at 6.4425)

- Musk Tweet (Tuesday US time): "Do you want Tesla to accept Doge?"

- DOGE copycat, China-based cryptocurrency Shiba Inu (SHIB), has also rocketed higher

- Escalation in Israel / Gaza conflict poses a risk to yen

- Heads up for US President Biden to speak Wednesday at 1930 GMT

- More downside for USD/JPY if US stocks keep tumbling

- Ray Dalio (Bridgewater founder) says government spending raises risks of inflation & USD devaluation

- China is threatening to drop Ericsson from 5G build unless Sweden drops its ban on Huawei

- US SEC says Bitcoin is a highly speculative investment, urges caution

- UN Special Envoy says Israel and Palestine are heading towards a full-scale war

- Coronavirus vaccine - CDC says 23 cases of blood clots in the US linked to J&J

- ICYMI - Indonesia is considering a plan to tax trading of cryptocurrencies (ps. nothingburger)

- ICYMI - OPEC still optimistic on oil demand despite India severe coronavirus 'challenges'

- Trade ideas thread - Wednesday 12 May 2021

- US gasoline, diesel, jet fuel network cyber-attack - 20% of Altlanta gas stations out of fuel

- The UN Security Council is to meet on Wednesday over Middle East fighting

- Private oil survey data shows headline draw in crude oil inventory

- ICYMI - People's Bank of China says will keep yuan FX rate basically stable

The fighting in the Middle East (Israel / Gaza) intensified with barrages of rocket attacks. Asia FX seemed as if it wanted to sit it out awaiting the US CPI data (due at 1230GMT today) but the geo-political events saw the USD gain across the major board. Escalation beyond Israel / Gaza has not been indicated yet but its something to keep an eye out for. As I post a statement from Israel says terrorist leaders from the Hamas military intelligence system were targeted and killed. With any luck the fighting has thus peaked, but of course, I am no expert. Oil markets showed little response but the yen did weaken a touch (admittedly intertwined with US dollar gains).

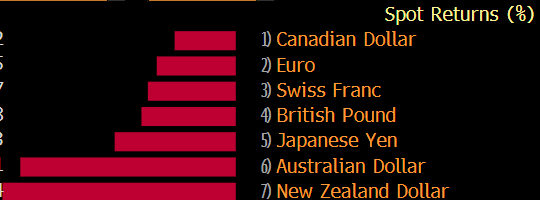

EUR, AUD, NZD, GBP, CAD, yen and CHF all fell against the dollar.

Of note for AUD traders, local bank CBA flagged that Australia might lose its AAA sovereign debt rating:

- We think the rating remains on a very fine line, with a downgrade the more likely outcome.

- The economic situation is clearly improving quickly

- but the government has spent budget improvement on new stimulus

See bullets above for more on this.

Regional equities ... there was no sign of the Bank of Japan buying interest in the Topix.

Japan's

Nikkei -0.6%, Topix -0.9%

China's

Shanghai Composite -0.04%

Hong

Kong's Hang Seng 0.16%

Australia's

S&P/ASX 200 -0.65%